- Sei price is on a recovery rally after securing support above the 70.5% Fibonacci level at $0.6375.

- With momentum rising, SEI market value could make a 20% climb to fill the market range at $0.8797.

- The bullish thesis will be invalidated upon a break and close below the 50% Fibonacci level at $0.4692.

Sei (SEI) price topped out after a massive rally beginning late November when the multi-month consolidation exhausted. Bearing the brunt of an overbought asset, SEI pulled back as the bulls took a breather, and are now making a comeback that could see the cryptocurrency reclaim its peak and potentially record a higher high.

Sei price to recover after surviving recent market crash

Sei (SEI) price was among the few tokens that were unaffected by the dip in Bitcoin (BTC) price during the January 2 crash. However, after a delayed reaction to the widespread liquidations, profit booking set in as investors cashed in on the exponential gains while giving the bulls a chance to refresh their buyer momentum.

With the 70.5% Fibonacci level holding as support at $0.6375, Sei price could reclaim the range high at $0.8828. This comes amid rising buying pressure, indicated by the northbound Relative Strength Index (RSI).

The position of the Awesome Oscillator (AO) is still in the positive territory also accentuates the bullish thesis, showing that the bulls continue to maintain a presence in the SEI market.

Enhanced buying pressure could see Sei price rise 20% to fill the market range at $0.8797, and potentially clear this level to record a higher local top around the $1.0000 psychological level.

SEI/USDT 1-day chart

On-chain metrics supporting Sei price bullish outlook

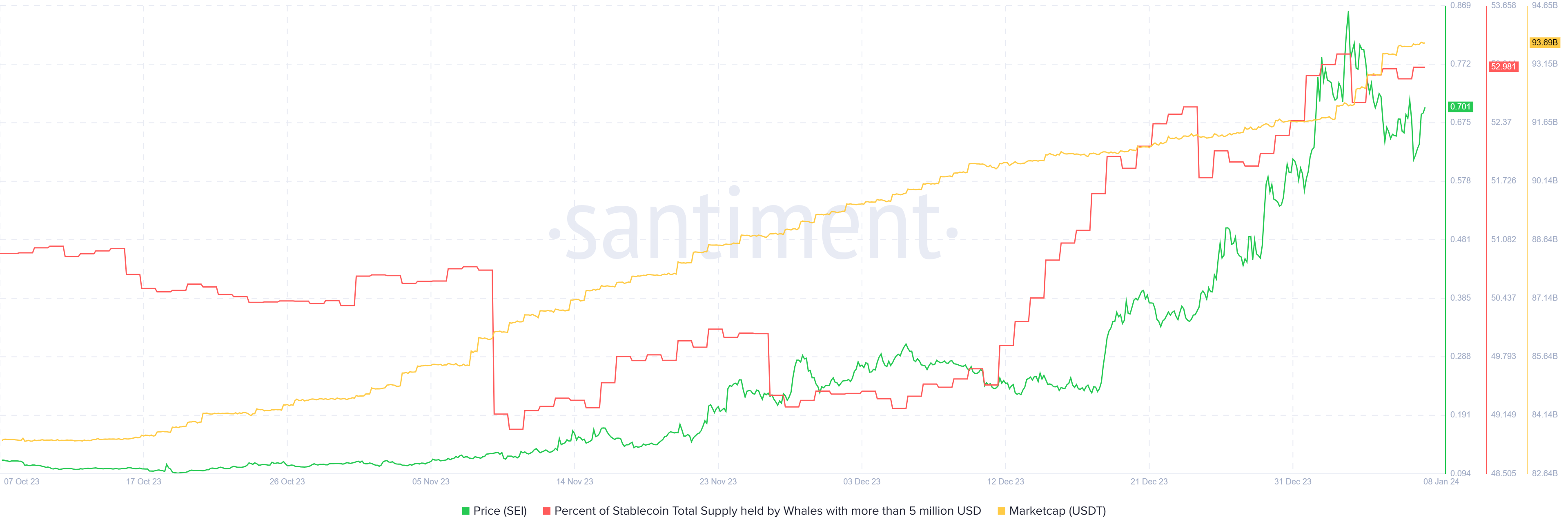

Santiment’s percentage of stablecoin total supply by whales holding over $5 million metric accentuates the bullish thesis, rising to show intention to purchase SEI at the first chance of a correction. Similarly, the Tether (USDT) market capitalization metric supports the outlook, rising to signify new money coming into the SEI market as traders look to buy.

SEI: % of stablecoin total supply held by whales, USDT market cap

Furthermore, the volume metric also registers a noticeable spike, showing the aggregate amount of SEI tokens across all transactions that happened on the network. With this metric soaring along with surging prices, it adds to the bullish fundamentals for Sei price.

SEI: Transaction volume

However, with the histogram bars of the AI flashing red, the bears are also at play. This coupled with the falling Average Directional Index (ADX) indicator, which suggests a weakening trend, making the possibility of a correction plausible.

If selling pressure increases, Sei price could descend below the 70.5% retracement level, possibly going as low as the 61.8% Fibonacci, the most critical retracement level. For the bullish outlook to be invalidated, however, the altcoin must record a candlestick close below the 50% Fibonacci at $0.4692.

The aforementioned move would set the path for a continued slump, with Sei price likely to revisit the 38.2%, or worse, 23.6% Fibonacci levels at $0.3723 and $0.2524, respectively.

fxstreet.com

fxstreet.com