Gold has made consecutive new all-time highs year-to-date, drawing investors’ attention and fueling what was already a significantly increased demand. Finbold selected two tokenized gold cryptocurrencies to invest in and gain exposure to the leading commodity

As of writing, the TradingView index for gold marks an all-time high of $2,431 per ounce. Furthermore, gold contracts closed the week – on April 12, Friday – at a valuation of $2,343 per ounce. Looking ahead, Bloomberg Intelligence‘s commodity expert forecasts gold could reach $3,000 per ounce.

However, investing in gold can sometimes be expensive and limiting, according to different geographic locations, or investment budgets.

Gold investment alternatives

For example, young Chinese investors have started buying physical gold beans to gain more accessible exposure to the precious metal. This is because these gold tokens have a lower minimum entry value. Additionally, they are easier to store and move than the usual gold bars and other physical variants of the world’s leading asset.

On the other hand, access to gold derivatives such as exchange-traded funds (ETFs) or diverse contracts face a similar issue of meaningful entry barriers for the average population. As a result, the price of gold in different markets may vary from underlying indexes like TradingView‘s.

Notably, some cryptocurrency projects address this demand, offering more accessible versions of synthetic gold tokens. Hence, allowing a more diverse exposure to the dominating commodity, besides easier storage, portability, and arbitrage opportunities.

2 gold tokens that anyone can buy

In this context, Finbold selected two of the most popular gold-backed cryptocurrencies or gold tokens. These assets are a synthetic version of the commodity, with mechanisms built to keep a peg to gold’s price.

Tether Gold (XAUt)

First, Tether has its own gold token under the ticker XAUt, using gold’s nomination as a supranational currency. The company is the leading stablecoin issuer in the cryptocurrency industry, controlling USDT, with over $105 billion market cap.

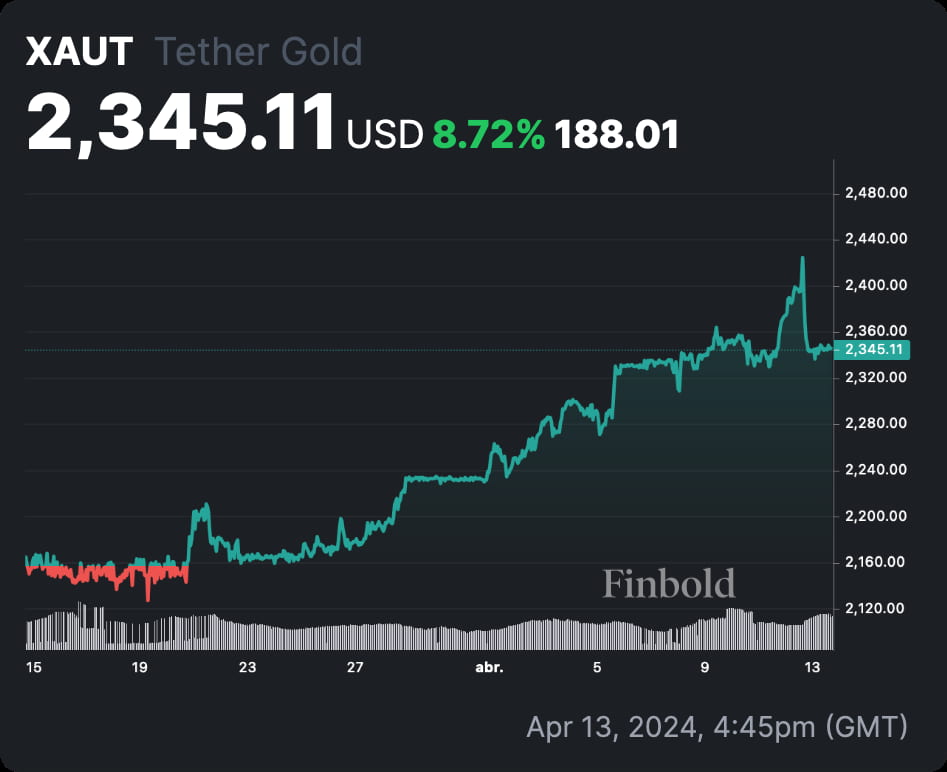

In particular, Tether’s tokenized gold trades slightly above TradingView‘s index, at $2,345 per ounce. XAUt is a $577.75 million market cap cryptocurrency, indicating a low-cap project according to the industry parameters.

PAX Gold (PAXG)

Pax Gold (PAXG) is a gold-backed cryptocurrency issued by Paxos, a regulated blockchain infrastructure. The company is mostly known for serving as Binance‘s dollar-stablecoin (BUSD) controller, despite having its own synthetic dollar, the USDP.

Interestingly, PAXG trades with a nearly 2% premium against the index, priced at $2,385 with ongoing volatility. Paxos’s gold token has a $435 million capitalization, ranked in the 159th position according to the CoinMarketCap index.

The HSBC also has its synthetic gold asset, although only available for the bank’s customers.

In conclusion, Tether and Paxos tokenized gold cryptocurrencies are the most solid tokens to accessibly invest in and gain exposure to the precious metal through blockchain infrastructure in a permissionless manner.

Nevertheless, the tokenized versions of the commodity have significant risks to consider and are prone to these entities’ honesty and health. Investors must do their due diligence and understand these risks before making financial decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com