Bitcoin (BTC) Faces Issues at $70,000, Solana (SOL) to Hit New Yearly High, Major XRP Problem Occurs

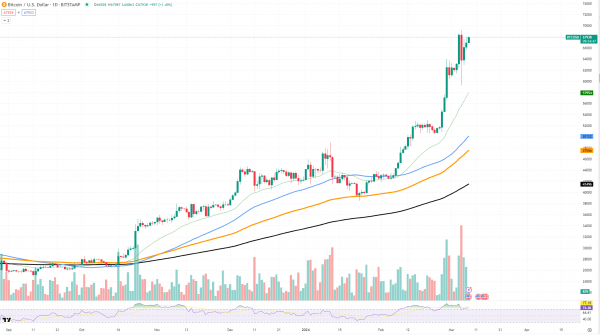

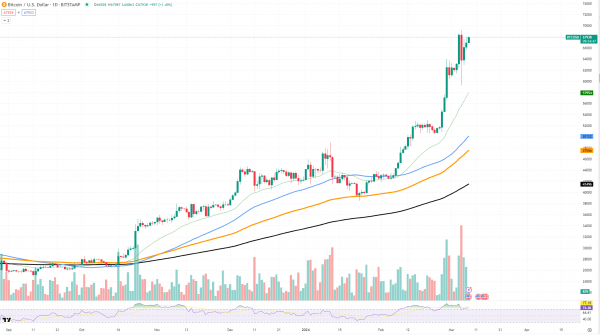

Bitcoin has recently faced significant resistance at the $70,000 mark, a psychological threshold that has proven to be a formidable barrier for the digital asset. Despite the enthusiasm surrounding its previous rallies, Bitcoin is currently exhibiting signs of a correction, which could impede its ability to achieve a rapid breakthrough above this level.

A detailed analysis of the TradingView chart reveals that Bitcoin has encountered a consolidation phase after a steep ascent. The current local support is found near the $57,932 level, aligning with the 50-day moving average, a crucial technical level that often acts as a stronghold for the asset’s price. This area may serve as a foundation for BTC if bearish pressure increases.

Conversely, resistance is firmly established at the $70,000 level. This is not just a numerical ceiling but a psychological one, where sell orders tend to cluster as investors aim to capitalize on round-number milestones.

If the correction deepens, Bitcoin may seek support at lower levels, with the next substantial support zone around the $50,117 mark, which is also near the 100-day moving average.

Market sentiment is mixed, reflecting the uncertainty of Bitcoin’s immediate path. While long-term confidence in Bitcoin remains high due to its established track record and increasing mainstream adoption, the short-term outlook is clouded by current market conditions and the $70,000 resistance level.

Solana rises

As the crypto market continues its dynamic course, Solana (SOL) emerges as a robust contender, gearing up to potentially set a new yearly high. With investors and traders eyeing SOL’s chart for signs of its next big move, the digital asset does not disappoint, showcasing strong bullish signals in its recent price action.

The SOL/USDT pair, as observed on the TradingView chart, is currently experiencing a commendable uptrend. The local support is firmly established around the $120.13 mark, a level that SOL has tested and bounced off recently, reaffirming its role as a reliable foothold for the asset. The next critical support lies near the $110 region, aligning with the 50-day moving average, serving as a secondary defense should any bearish shift occur.

On the resistance spectrum, SOL faces its immediate challenge near the $155 zone. A convincing break above this level could very well propel Solana to carve out new highs for the year, fueling bullish sentiment across the market. The current price structure, characterized by successive higher highs and higher lows, underscores the possibility of such a breakout

XRP faces hurdle

XRP is currently facing a significant technical challenge on the charts, as a concerning pattern emerges that could signal potential headwinds for the cryptocurrency.

The recent price action of XRP/USDT indicates a struggle to maintain its upward momentum. After reaching a peak, the asset has begun to set successively lower highs — a technical pattern that can dampen bullish sentiment and may lead to a trend reversal. This development is pivotal because lower highs are frequently associated with diminishing buying pressure and the beginning of a downturn.

Current technical analysis places XRP’s local support at the $0.55 mark, which is in proximity to the 50-day moving average, a critical juncture for the asset to hold to avert a bearish outlook. Should XRP fall below this support level, the door could open for further declines, with the next level of substantial support near $0.50, a psychological and technical support level.

Conversely, resistance levels have formed near the recent high around $0.63, where XRP has faced rejection, reinforcing the bearish pattern of lower highs. For XRP to invalidate this troubling trend, it would need to break through this resistance with conviction and sustained volume, a move that would require significant market buy-in.

The formation of lower highs is a troubling signal for XRP, often indicating that sellers are becoming more aggressive and buyers are unable to push the price to new highs.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Polygon

Polygon  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stellar

Stellar  Monero

Monero  Stacks

Stacks  Mantle

Mantle  Filecoin

Filecoin  Render

Render  dogwifhat

dogwifhat  Injective

Injective  Bittensor

Bittensor  OKB

OKB  Hedera

Hedera  Cronos

Cronos  Maker

Maker  Immutable

Immutable  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  First Digital USD

First Digital USD  Bonk

Bonk  Arweave

Arweave  Sui

Sui  Optimism

Optimism  The Graph

The Graph  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  THORChain

THORChain  Mantle Staked Ether

Mantle Staked Ether  Theta Network

Theta Network  WhiteBIT Coin

WhiteBIT Coin  Notcoin

Notcoin  Aave

Aave  Jupiter

Jupiter  Ondo

Ondo  Pyth Network

Pyth Network  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  Fantom

Fantom  Brett

Brett  Core

Core  Celestia

Celestia  Algorand

Algorand  Sei

Sei  ether.fi Staked ETH

ether.fi Staked ETH  Quant

Quant  Flow

Flow  Gate

Gate  MANTRA

MANTRA  Marinade Staked SOL

Marinade Staked SOL  Popcat

Popcat  KuCoin

KuCoin  Beam

Beam  MultiversX

MultiversX  Bitcoin SV

Bitcoin SV  Axie Infinity

Axie Infinity  Helium

Helium  GALA

GALA  Ethereum Name Service

Ethereum Name Service  BitTorrent

BitTorrent  EOS

EOS  Tokenize Xchange

Tokenize Xchange  NEO

NEO  ORDI

ORDI  Akash Network

Akash Network  dYdX

dYdX  Ethena

Ethena  Tezos

Tezos  eCash

eCash  The Sandbox

The Sandbox  USDD

USDD  Conflux

Conflux  cat in a dogs world

cat in a dogs world  Worldcoin

Worldcoin  Ronin

Ronin  Starknet

Starknet  SATS (Ordinals)

SATS (Ordinals)  NEXO

NEXO  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Decentraland

Decentraland  Raydium

Raydium  Chiliz

Chiliz  Pendle

Pendle  PayPal USD

PayPal USD  BOOK OF MEME

BOOK OF MEME  Mog Coin

Mog Coin  Mina Protocol

Mina Protocol  AIOZ Network

AIOZ Network  Oasis Network

Oasis Network  Tether Gold

Tether Gold  ZKsync

ZKsync  Synthetix Network

Synthetix Network  Gnosis

Gnosis  IOTA

IOTA  Nervos Network

Nervos Network  DeXe

DeXe  Swell Ethereum

Swell Ethereum  Klaytn

Klaytn  Astar

Astar  ApeCoin

ApeCoin  Wormhole

Wormhole  LayerZero

LayerZero  Aerodrome Finance

Aerodrome Finance  Livepeer

Livepeer  Safe

Safe  TrueUSD

TrueUSD  Axelar

Axelar  Zcash

Zcash  1inch

1inch  Terra Luna Classic

Terra Luna Classic  Bitcoin Gold

Bitcoin Gold  Kava

Kava  PancakeSwap

PancakeSwap  Theta Fuel

Theta Fuel  Aevo

Aevo  Illuvium

Illuvium  PAX Gold

PAX Gold  Trust Wallet

Trust Wallet  APENFT

APENFT  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  IoTeX

IoTeX  WEMIX

WEMIX  Turbo

Turbo  ConstitutionDAO

ConstitutionDAO  H2O Dao

H2O Dao  MX

MX  Jito

Jito  Gravity

Gravity  WOO

WOO  Galxe

Galxe  Stader ETHx

Stader ETHx  Ether.fi

Ether.fi  SafePal

SafePal  Manta Network

Manta Network  Compound

Compound  Memecoin

Memecoin  Arkham

Arkham  GMT

GMT  cETH

cETH  SuperVerse

SuperVerse  SingularityNET

SingularityNET  Golem

Golem  Rocket Pool

Rocket Pool  Dymension

Dymension  0x Protocol

0x Protocol  Blur

Blur  Kusama

Kusama  Avail

Avail  Osmosis

Osmosis  PONKE

PONKE  Zilliqa

Zilliqa  Beldex

Beldex  AltLayer

AltLayer  Dash

Dash  Echelon Prime

Echelon Prime  Curve DAO

Curve DAO  CorgiAI

CorgiAI  Enjin Coin

Enjin Coin