BRETT Price Up 8% This Week: Is the Bullish Trend Set To Continue?

The price of the Base-based memecoin Brett (BRETT) surged by 8% in the past seven days. It has surpassed the horizontal neckline of $0.1000 and reached two months’ highest trajectory. BRETT price could gain more upside as it recorded a falling wedge pattern breakout this week.

Additionally, it has climbed above the key EMAs and guides a bullish bias. This contrast suggested that the selling pressure might end, potentially setting the stage for a bullish trend.

Additionally, investors’ behavior suggested that BRETT crypto will regain bullishness and may retain the ATH region soon. Since the beginning of October, BRETT crypto has witnessed buyer accumulation from the lower levels. It has surged over 38% in the last 20 days.

— Advertisement —

BRETT Price Sees Bullish Signals: Is a Rally Imminent?

The BRETT price reached a monthly high of $0.1052, noting a weekly surge of over 8.20%. With the rising positive developments, the token continued to gain investor interest. The bullish trend was intact, and the memecoin displayed significant whale accumulation.

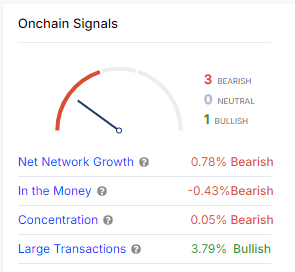

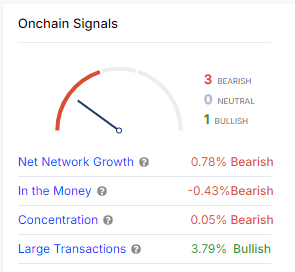

On-Chain Signal | Source: IntoTheBlock

Large transactions noted a surge of over 3.79%, which gave a bullish conviction. Bulloro is a crypto analyst. In a recent tweet on X, he said the BRETT token has broken out of the inverse head and shoulders pattern.

This happened after retesting the 20-day EMA mark. It may approach its ATH region by November and display bullish cues.

$BRETT is about to make the most explosive move upwards.

We have broken out of the Inverted Head and Shoulders pattern, we have completed the retest, and now we are heading towards a New ATH.

I’m expecting this to happen in November as the elections approach.

🔜 $80B $BRETT pic.twitter.com/LKuxiI0HnC

— Bulloro (@bullorochanel) October 18, 2024

Further, the 50% Fib level was positioned at $0.1080, which could be a good entry to go long. A daily close above $0.1220 would trigger further upside. It may soon revisit the ATH mark of $0.1939.

On-Chain Data and Technical Indicators Support Bullish Trend

As of this writing, the MACD reading was positive. Also, the BRETT price was positioned above the key EMAs, which supported the bounce. The Relative Strength Index (RSI) line stayed above the midline region, 59 at press time, giving bullish cues.

BRETT Price Chart | Source: TradingView

Additionally, the On-Balance-Volume (OBV) displayed a spike to 4.212 Billion, noting significant accumulation. Considering this indicator’s view, buyers had outpaced the sellers. The price action indicates that the memecoin has formed a series of higher highs and witnessed bullish momentum.

Furthermore, the media buzz was favoring the rise. According to Messari’s data, users were speculating about the BRETT token on the X platform.

Source: Messari

For the last three months, the count of followers recorded a massive spike. The number of followers on X reached 117.56k, witnessing significant growth.

Likewise, the OI-weighted funding rate remained positive for the past four weeks, 0.0092% at press time. This positive rate signified the sustained demand for the long positions.

Source: Coinglass

The long/short ratio was noted to be around 0.8804, slightly favoring the rise. Short positions have been covered in the past sessions. The immediate support zones for BRETT crypto were $0.09970 and $0.09910. At the same time, the upside hurdles were $0.1120 and $0.1230.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Quant

Quant  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  KuCoin

KuCoin  Pyth Network

Pyth Network  NEXO

NEXO  Kaia

Kaia  Tezos

Tezos  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Zcash

Zcash  Eigenlayer

Eigenlayer  Jito

Jito  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  SPX6900

SPX6900  Popcat

Popcat  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  Synthetix Network

Synthetix Network  eCash

eCash  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  dYdX

dYdX  Amp

Amp  Axelar

Axelar  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Turbo

Turbo  Safe

Safe  Super OETH

Super OETH  Usual

Usual  Oasis

Oasis  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD