NEAR Price Prediction: Is Fall To $1 Inevitable For NEAR Price?

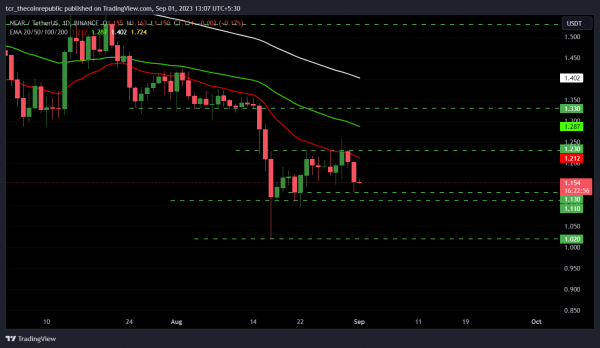

- 1 NEAR price currently trades at $1.153 while witnessing a loss of 0.26% during the intraday trading session.

- 2 Near price trades below all the major exponential moving averages.

- 3 The year-to-date return of NEAR is -8.04%.

NEAR price has been in a strong downtrend since the start of February, forming lower lows and melting toward the $1 level. During mid-June, the cryptocurrency price started a bullish journey in order to recover from the losses but the move was halted at $1.53 level.

The price melted below the level from where the bullish rally began after the rejection. Recently, the price formed support at $1.11 and attempted to surge above $1.30 but the bears had a strong presence near the $1.23 level. Bears can push prices downward and the bullish move turned out to be a short-term pullback.

Source: NEAR/USDT By TradingView.

Currently, the asset price is headed downward toward the recent support of $1.11. The previous candle closed as a strong bearish candle and the current candle is melting in order to break the low to fall further downward.

There is also minor support at $1.13 and the NEAR price might form a support to retest the resistance level of $1.23.

Chain Activity Of Near Protocol

The daily active addresses of Near Protocol have surged since 29 August, 52,810 to 251,080, which is the highest in 2023. In the past 90 days, the daily active addresses have increased by 401.4% which is a good sign for the NEAR Protocol. The daily transaction has also witnessed a strong uptick of 55.8% in the last 90 days, reaching 507,882.

However, the total value locked has taken a hit and fell 5.4% in the past 30 days. The current total value locked is at $33.9 Million. The decentralized exchange volume has increased by 42.5% in the past 30 days, amounting to $1.8 Million.

Will NEAR Price Continue Falling?

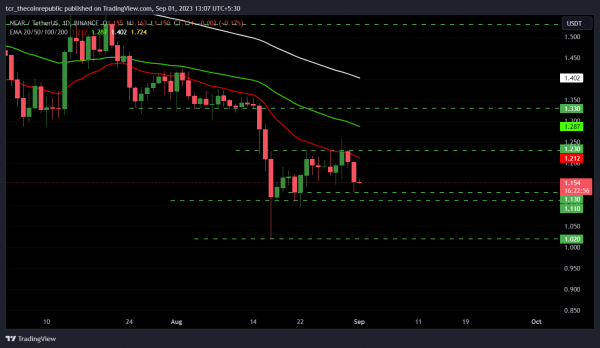

Source: NEAR/USDT By TradingView.

The cryptocurrency price has melted below 20, 50, 100, and 200-day exponential moving averages, indicating bearish momentum. The 20-day EMA is also acting as a resistance for the price. Chaikin money flow score has jumped above the 0 mark and currently trades at 0.09, suggesting strength in the market.

However, the relative strength index is still below the 50 mark and trades at 37.24, implying a confluence of bears over the price. If the bearish momentum continues, RSI will soon enter the oversold zone.

Near price has rejected the 20-day SMA of Bollinger and is headed toward the lower band of Bollinger which resides near the $1.08 level. The long-short ratio is 1.03 with 50.77% longs and 49.23% shorts indicating that bulls have higher positions in the last 24 hours.

Conclusion

The overall market structure and price action of NEAR price is bearish after the rejection from $1.23. Technical parameters also favor the selling side.

Technical Levels

- Major support: $1.11 and $1.02

- Major resistance: $1.23 and $1.33

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Quant

Quant  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  KuCoin

KuCoin  Pyth Network

Pyth Network  NEXO

NEXO  Kaia

Kaia  Tezos

Tezos  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Zcash

Zcash  Eigenlayer

Eigenlayer  Jito

Jito  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  SPX6900

SPX6900  Popcat

Popcat  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  Synthetix Network

Synthetix Network  eCash

eCash  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  dYdX

dYdX  Amp

Amp  Axelar

Axelar  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Turbo

Turbo  Safe

Safe  Super OETH

Super OETH  Usual

Usual  Oasis

Oasis  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD