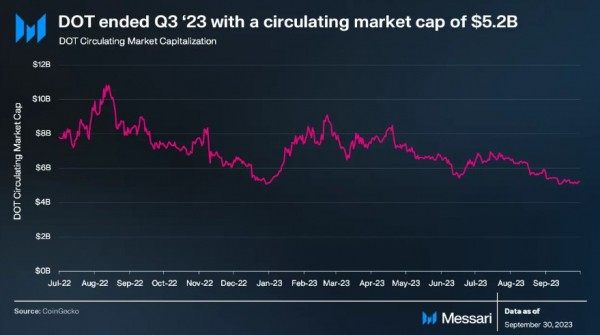

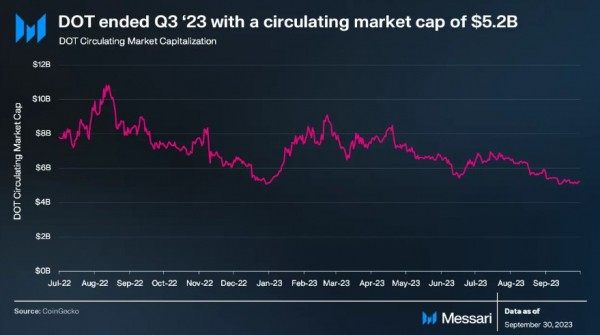

Polkadot (DOT) Market Cap Dips: Q3 Sees 16% Decrease In Value

Polkadot (DOT), one of the prominent blockchain networks in the crypto space, experienced a 16% decline in market capitalization in the third quarter (Q3) of 2023, according to a recent report from Messari.

This decline came after a moderate downturn in the overall cryptocurrency market during Q3, despite favorable court rulings for XRP and Grayscale. The total crypto market capitalization declined by 5.8%, with Bitcoin (BTC) and Ethereum (ETH) falling by 7.5% and 10.0%, respectively.

Polkadot Closes Q3 With $5.2 Billion Market Cap

As reported by Messari, Polkadot’s market capitalization closed at $5.2 billion, positioning it as the 13th largest crypto asset by market cap in Q3 2023 (currently 15th).

Polkadot’s financial structure is based on a weight-based fee model, which differs from the gas-metering model in other networks, such as Ethereum.

Transaction fees in Polkadot are determined and charged before execution, with the calculation comprising a weight fee reflecting computational resources, a length fee based on transaction size, and an optional tip to incentivize block authors.

In Q3 2023, Polkadot generated revenue amounting to $94,000, representing a 3% decrease compared to the previous quarter. Messari suggests that Polkadot’s revenue tends to be relatively lower compared to its competitors due to the network’s structural design.

On the other hand, the native token of Polkadot, DOT, serves three primary purposes: governance, staking, and parachain bonding. During Q3 2023, the staking percentage of DOT rose by 12% compared to the previous quarter, reaching 49%.

This increase led to reduced staking rewards and a 12% decline in the annualized nominal yield to 15%. According to Messari, the close alignment of Polkadot’s staking rate with the ideal rate demonstrates the effectiveness of its mechanism.

Polkadot’s OpenGov Milestone

The Polkadot treasury supported various initiatives in Q3, including software development, bounties, client upgrades, and community events like meetups and hackerspaces.

According to Messari, the implementation of OpenGov on June 15 marked a significant milestone, revolutionizing treasury management and enabling concurrent proposals with distinct requirements. At the end of the quarter, the Polkadot treasury held approximately 45 million DOT ($185 million).

Furthermore, Polkadot has recently completed the official release of Polkadot 1.0, marking the achievement of a significant milestone outlined in the Polkadot whitepaper.

The network’s codebase has been fully transitioned to a repository managed by the community through Polkadot OpenGov and the Technical Fellowship. The roadmap for the next iteration, Polkadot 2.0, will be determined through community discussions and consensus.

Founder Gavin Wood has proposed ideas for additional mechanisms to allocate Polkadot’s block space and for creating treaty-like agreements between multiple blockchains called “accords.”

As of this writing, the DOT token has exhibited a noteworthy upward trend since October 19, closely following Bitcoin’s lead. Presently, the token is trading at $4,839, reflecting a notable increase of over 16% within the past fourteen days.

Featured image from Shutterstock, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Binance-Peg WETH

Binance-Peg WETH  Injective

Injective  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Gate

Gate  JasmyCoin

JasmyCoin  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  NEXO

NEXO  Pyth Network

Pyth Network  KuCoin

KuCoin  Kaia

Kaia  Tezos

Tezos  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  dYdX

dYdX  AIOZ Network

AIOZ Network  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Core

Core  Curve DAO

Curve DAO  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Fartcoin

Fartcoin  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  Zcash

Zcash  ApeCoin

ApeCoin  Jito

Jito  Mog Coin

Mog Coin  Eigenlayer

Eigenlayer  Akash Network

Akash Network  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  SPX6900

SPX6900  Popcat

Popcat  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  Synthetix Network

Synthetix Network  eCash

eCash  Gnosis

Gnosis  Binance-Peg Dogecoin

Binance-Peg Dogecoin  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Ether.fi Staked BTC

Ether.fi Staked BTC  dYdX

dYdX  Amp

Amp  Axelar

Axelar  ZKsync

ZKsync  Notcoin

Notcoin  Tether Gold

Tether Gold  CHEX Token

CHEX Token  LayerZero

LayerZero  Peanut the Squirrel

Peanut the Squirrel  Mantle Restaked ETH

Mantle Restaked ETH  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Grass

Grass  Baby Doge Coin

Baby Doge Coin  Turbo

Turbo  Usual

Usual  Vana

Vana  Safe

Safe  Super OETH

Super OETH  Oasis

Oasis  Echelon Prime

Echelon Prime  ORDI

ORDI  cat in a dogs world

cat in a dogs world  Blur

Blur  1inch

1inch  Trust Wallet

Trust Wallet  Beldex

Beldex  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  DeXe

DeXe  Livepeer

Livepeer  Arkham

Arkham  Kusama

Kusama  TrueUSD

TrueUSD  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad