Polygon (MATIC) Price Could See Bullish Push Following Consolidation – Here’s Why

The price of Polygon (MATIC) is witnessing a resurgence, indicated by a recovery in daily active addresses following steep declines. This uptick, supported by the RSI 7D, suggests potential for further buying that could boost MATIC’s price.

However, caution is advised as EMA lines point towards ongoing consolidation, hinting at a less bullish outlook for MATIC in the near term. Investors should weigh these contrasting signals carefully.

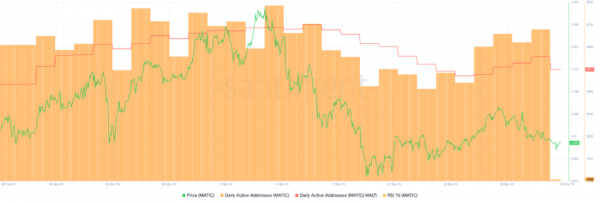

Polygon Active Addresses Are Growing Again

Polygon (MATIC) experienced a significant milestone on March 14, when the number of daily active addresses soared to 3,301, coinciding with a price surge to $1.27, marking its highest value since February 2023.

This peak reflects a strong correlation between MATIC’s price and its active user base, suggesting that higher engagement levels can drive up MATIC’s price.

MATIC Daily Active Addresses. Source: Santiment.

However, a subsequent decline in daily active addresses to 2,550 by March 24 indicated a cooling period. Remarkably, from March 24 to March 28, the daily active addresses rebounded to 3,069, with the Daily Active Addresses 7D Moving Average indicating an uptrend.

This recovery suggests a renewed interest in MATIC, potentially signaling an upcoming price increase. The relationship between active addresses and MATIC’s price is crucial, as rising user engagement often precedes positive price movements, providing a bullish outlook for investors and highlighting the platform’s growing adoption and utility.

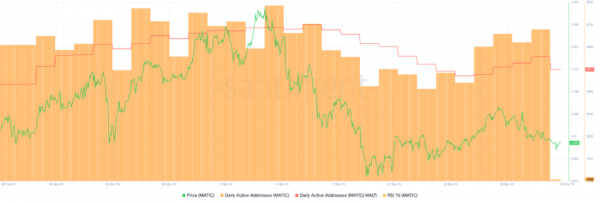

RSI Shows Room For Growth

The Relative Strength Index (RSI) for MATIC has seen a notable shift, currently positioned at 59, a decrease from 66 at its price peak on March 13 and down from 62 just two days ago.

MATIC RSI 7D. Source: Santiment.

This decline in RSI, is a momentum oscillator that gauges the speed and change of price movements. This might signal a cooling period for MATIC’s previous bullish momentum. RSI values range from 0 to 100, with thresholds set at 70 for overbought conditions, indicating a potential price reversal. It also has a threshold of 30 for oversold conditions, suggesting a possible price increase.

Given that MATIC’s RSI is now at 59, falling from higher values, it likely points towards a period of consolidation. This level suggests that MATIC is neither overbought nor oversold. This indicates that the price might stabilize in the short term as market participants assess its next directional move.

MATIC Price Prediction: EMA Lines Are Not Bullish

Despite the positive indicators from growing daily active addresses and a healthy RSI for MATIC, the EMA (Exponential Moving Average) lines present a less optimistic outlook. EMA lines, which are a moving average that places a greater weight and significance on the most recent data points, are not aligning in a bullish pattern for MATIC price.

Specifically, MATIC’s short-term EMA lines are situated below its long-term lines, and all are above the current price line. This configuration typically indicates a bearish sentiment, suggesting that the price is under pressure and could be expected to decline if current trends continue.

MATIC 4H Price Chart and EMA Lines. Source: TradingView.

However, MATIC finds robust support at $0.95 and $0.90, hinting at potential consolidation around these levels from its current price. Should the market sentiment shift negatively, a downtrend could drive MATIC’s price down to $0.81.

Conversely, a positive change in market dynamics might propel MATIC towards resistance levels at $1.17 and possibly $1.30 if sustained momentum is achieved.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Gate

Gate  Quant

Quant  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  Pyth Network

Pyth Network  KuCoin

KuCoin  NEXO

NEXO  Tezos

Tezos  Kaia

Kaia  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Arweave

Arweave  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Decentraland

Decentraland  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Pendle

Pendle  Zcash

Zcash  ApeCoin

ApeCoin  Fartcoin

Fartcoin  ether.fi Staked ETH

ether.fi Staked ETH  Jito

Jito  Eigenlayer

Eigenlayer  Mog Coin

Mog Coin  Chiliz

Chiliz  Akash Network

Akash Network  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  Popcat

Popcat  SPX6900

SPX6900  Mina Protocol

Mina Protocol  Jupiter Staked SOL

Jupiter Staked SOL  Compound

Compound  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  SuperVerse

SuperVerse  PancakeSwap

PancakeSwap  Ronin

Ronin  eCash

eCash  Synthetix Network

Synthetix Network  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  Amp

Amp  Axelar

Axelar  dYdX

dYdX  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  Terra Luna Classic

Terra Luna Classic  CHEX Token

CHEX Token  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Turbo

Turbo  Vana

Vana  Safe

Safe  Super OETH

Super OETH  cat in a dogs world

cat in a dogs world  Oasis

Oasis  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  Usual

Usual  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD