Ripple (XRP) Comeback Plan: Bulls Aim for 85% Price Rise on This Resistance Break

Ripple’s XRP price has decreased considerably since its yearly high. The price is at risk of closing below the $0.55 horizontal area.

Whether the price closes below the area or bounces will determine the future price trend.

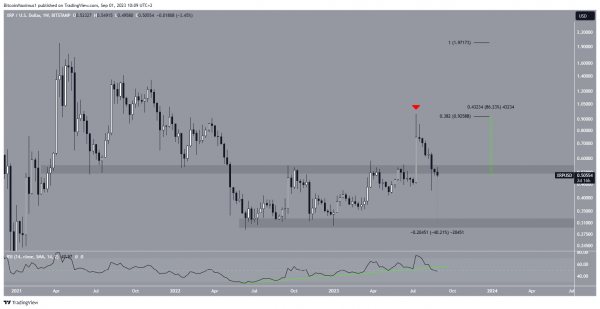

XRP Price Falls Below Long-Term Support

The technical analysis in the weekly time frame for XRP gives a mostly bearish outlook. There are several reasons for this.

Firstly, the XRP price was rejected by the 0.382 Fib retracement level at $0.93 as soon as it reached a new yearly high. This created a very long upper wick (red icon), considered a sign of selling pressure.

Crypto investing, simplified. Get XRP price predictions here.

Secondly, the price is now falling below the long-term $0.55 horizontal support area. The area has intermittently acted as both resistance and support since the beginning of 2021. Therefore, a weekly close below will confirm that the trend is bearish. In that case, a 40% drop to the $0.30 horizontal support area will likely be the future price scenario.

XRP/USD Weekly Chart. Source: TradingView

Finally, the weekly RSI is turning bearish. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite.

The indicator broke down from an ascending support line (green line) and is now at risk of falling below 50. However, similarly to the price action, the RSI has not closed below 50 yet, offering hope for a potential bullish reversal. In that case, the 0.382 Fib retracement resistance would be 85% above the current price.

It is also worth mentioning that the Ripple vs. SEC case will continue next year, with the next trial date being April 2024.

Check Out the Best Upcoming Airdrops in 2023

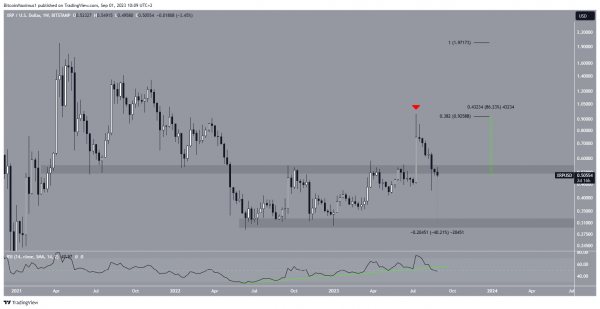

Will XRP Price Fall to Ascending Support?

The daily timeframe readings support the bearish ones from the weekly timeframe. The XRP price has fallen considerably below the main support area at $0.54 in this timeframe. In fact, the price has validated the area as resistance twice (red icons).

Additionally, the daily RSI is below 50 and falling. These are both considered signs of a bearish trend.

If the downward movement continues, there is an ascending support line at $0.39. A decrease in it would amount to a drop of 23%, measuring from the current price. The line could provide temporary relief before the long-term horizontal support area at $0.30.

XRP/USDT Daily Chart. Source: TradingView

Despite this bearish XRP price prediction, a close above the $0.55 horizontal area will mean that the breakdown is invalid and the trend is still bullish. In that case, an 85% increase to the $0.93 resistance will likely be the future price outcome.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Sui

Sui  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  Virtuals Protocol

Virtuals Protocol  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Binance-Peg WETH

Binance-Peg WETH  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Gate

Gate  Quant

Quant  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  Pyth Network

Pyth Network  KuCoin

KuCoin  NEXO

NEXO  Tezos

Tezos  Kaia

Kaia  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Raydium

Raydium  Brett

Brett  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Arweave

Arweave  Core

Core  AIOZ Network

AIOZ Network  IOTA

IOTA  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Fartcoin

Fartcoin  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Pendle

Pendle  Zcash

Zcash  ApeCoin

ApeCoin  Jito

Jito  ether.fi Staked ETH

ether.fi Staked ETH  Mog Coin

Mog Coin  Akash Network

Akash Network  Eigenlayer

Eigenlayer  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Wormhole

Wormhole  Conflux

Conflux  USDD

USDD  Popcat

Popcat  Jupiter Staked SOL

Jupiter Staked SOL  Mina Protocol

Mina Protocol  Compound

Compound  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  SPX6900

SPX6900  Ronin

Ronin  SuperVerse

SuperVerse  PancakeSwap

PancakeSwap  eCash

eCash  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Synthetix Network

Synthetix Network  Gnosis

Gnosis  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  Chia

Chia  Axelar

Axelar  dYdX

dYdX  Amp

Amp  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Grass

Grass  Turbo

Turbo  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Super OETH

Super OETH  Safe

Safe  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Oasis

Oasis  Echelon Prime

Echelon Prime  Blur

Blur  Beldex

Beldex  1inch

1inch  Usual

Usual  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  DeXe

DeXe  Livepeer

Livepeer  pumpBTC

pumpBTC  Creditcoin

Creditcoin  APENFT

APENFT  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  TrueUSD

TrueUSD  Arkham

Arkham