Ripple (XRP) IPO Speculation Mounts – How Will Price React?

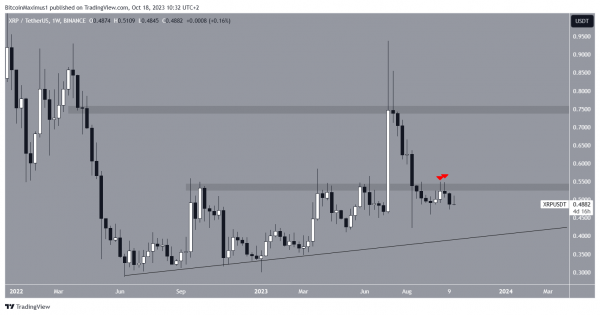

The Ripple XRP price has decreased since July and recently dropped below the crucial support level of $0.53.

A recent job posting has sparked speculation of a potential Ripple Initial Public Offering (IPO). The question now becomes: Can the XRP price recover?

Ripple Continues Descent Below Support

The weekly technical analysis shows that the XRP price has been mired in an ongoing decrease since July when it traded at its yearly high of $0.94.

The downward movement culminated with a low of $0.42. This caused a breakdown from the $0.53 horizontal support area.

Following a brief rebound, the price temporarily rose above the $0.53 level but failed to maintain it, as indicated by consecutive long upper wicks (red icons). Last week, the decline resumed.

The XRP price has followed a long-term ascending support trendline since June 2022.

XRP/USDT Weekly Chart. Source: TradingView

Some interesting Ripple news hit the market today. A new job opening for the “Shareholders Communication Senior Manager” position has created speculation among X users that Ripple Labs is considering an IPO.

An IPO marks the initial sale of a company’s stock to the public. Before an IPO, the company is typically privately owned and financed by investors like its founders and venture capitalists.

This also comes shortly after Ripple Labs CFO Kristina Campbell announced her departure from the company.

Finally, the Ripple Swell conference is approaching. The flagship event will be held on November 8-9 and will have numerous speakers, including Brad Garlinghouse, the CEO of Ripple Labs.

Click here for Ripple-XRP price predictions.

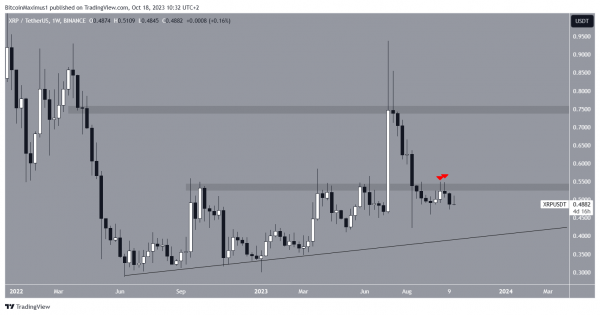

XRP Price Prediction: What Does the RSI Say?

The weekly Relative Strength Index (RSI) supports the ongoing downward XRP trend.

Traders use the RSI as a momentum indicator to assess whether a market is overbought or oversold and decide whether to buy or sell an asset.

An RSI reading above 50 in an upward trend favors the bulls, while a reading below 50 suggests the opposite. The RSI is falling below 50, both of which are signs of a bearish trend.

Additionally, the RSI has broken below an ascending support trendline (green) that had been in place since July, further supporting the ongoing decline in XRP‘s price.

If the downward trend persists, XRP could potentially drop by another 20% and reach the previously mentioned long-term ascending support trendline at $0.40.

XRP/USDT Weekly Chart. Source: TradingView

However, despite this bearish XRP price prediction, a weekly close above $0.53 would indicate a bullish trend is still in play.

In such a scenario, the price could rise by 55% and reach the next resistance level at $0.75.

For BeInCrypto’s latest crypto market analysis, click here.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Sui

Sui  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  Pyth Network

Pyth Network  NEXO

NEXO  KuCoin

KuCoin  Kaia

Kaia  Tezos

Tezos  Brett

Brett  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  dYdX

dYdX  IOTA

IOTA  AIOZ Network

AIOZ Network  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Core

Core  Curve DAO

Curve DAO  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Decentraland

Decentraland  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Fartcoin

Fartcoin  Pendle

Pendle  ether.fi Staked ETH

ether.fi Staked ETH  ApeCoin

ApeCoin  Zcash

Zcash  Eigenlayer

Eigenlayer  Jito

Jito  Mog Coin

Mog Coin  Akash Network

Akash Network  ai16z

ai16z  Chiliz

Chiliz  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  Popcat

Popcat  SPX6900

SPX6900  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  SuperVerse

SuperVerse  PancakeSwap

PancakeSwap  eCash

eCash  Synthetix Network

Synthetix Network  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Chia

Chia  dYdX

dYdX  Amp

Amp  Ether.fi Staked BTC

Ether.fi Staked BTC  Notcoin

Notcoin  Axelar

Axelar  ZKsync

ZKsync  Tether Gold

Tether Gold  CHEX Token

CHEX Token  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Grass

Grass  Baby Doge Coin

Baby Doge Coin  Usual

Usual  Turbo

Turbo  Vana

Vana  Super OETH

Super OETH  Safe

Safe  cat in a dogs world

cat in a dogs world  Oasis

Oasis  Echelon Prime

Echelon Prime  ORDI

ORDI  Blur

Blur  1inch

1inch  Trust Wallet

Trust Wallet  Beldex

Beldex  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Creditcoin

Creditcoin  PAX Gold

PAX Gold  Livepeer

Livepeer  pumpBTC

pumpBTC  APENFT

APENFT  DeXe

DeXe  Gigachad

Gigachad  Arkham

Arkham  Kusama

Kusama  Goatseus Maximus

Goatseus Maximus  Nervos Network

Nervos Network