Solana (SOL) Price Now 15% Shy of All-Time High as Open Interest Soars to $4 Billion

The crypto market has evolved beyond macroeconomics — it now has ties to politics. If you have doubts, look at the prices of assets like Solana (SOL) since Donald Trump emerged as the winner of the US presidential elections. For instance, Solana all-time high, which was 40% away some weeks back, now only needs a 15% hike to clip a new peak.

However, that is not the only thing happening with the altcoin. In this analysis, BeInCrypto reveals what else is going on and what could be next for SOL’s price.

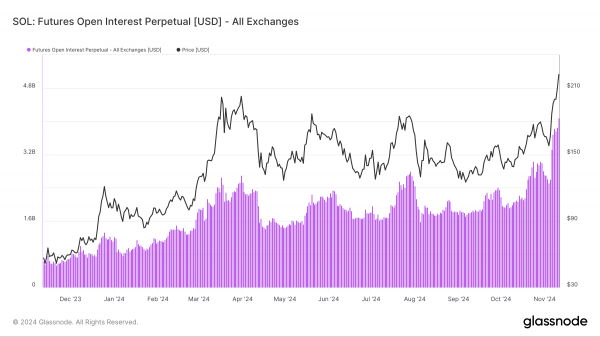

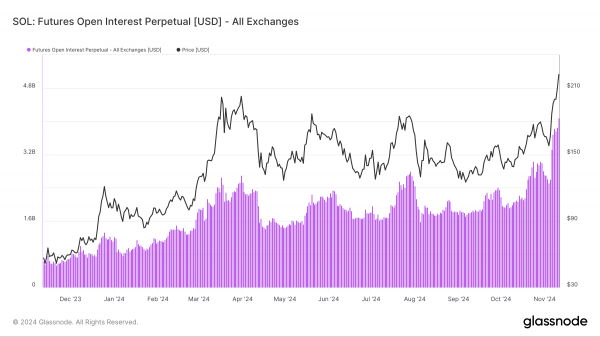

Solana Open Interest Hits Record High

Solana’s all-time high of $260 occurred in November 2021. In March this year, the altcoin attempted to surpass that level but encountered rejection, leading to a double-digit drawdown.

However, things have changed since last week, as SOL’s price has increased by 37% in the last seven days. This hike has brought it closer to its all-time high, and it now needs a 15% increase to retest the region. But that is not the only thing.

According to Glassnode, SOL Open Interest has hit a record high of $4 billion. OI, as the metric is commonly called, is the sum of the value of all open contracts in the market.

Increasing open interest signifies new capital entering the market and suggests a rise in speculative activity. Conversely, decreasing open interest suggests money is flowing out. Therefore, the recent hike in Solana’s OI suggests that, with new money flowing into the cryptocurrency’s contracts, the price might go higher.

Solana Open Interest. Source: Glassnode

The Sharpe ratio is another metric suggesting that Solana’s all-time high could become a reality in the short term. For context, the Sharpe ratio measures an asset’s risk-adjusted return.

Furthermore, the higher the Sharpe ratio, the better the returns relative to the amount of risk taken. On the other hand, if the ratio is negative, it means that the potential rewards might not be worth the risk.

Based on Messari’s data, the Sharpe ratio for SOL has risen to 0.48. This notable increase suggests that buying SOL at its current market value could yield strong returns for investors looking to accumulate.

Solana Sharpe Ratio. Source: Messari

SOL Price Prediction: Higher than $260 Soon

On the daily chart, SOL’s price encountered resistance at $222.26. However, the Chaikin Money Flow (CMF) suggests that this obstacle might not stop the altcoin from continuing its rally.

The CMF is an oscillator that measures buying and selling pressure, giving a score between -100 and +100. Positive values indicate an uptrend, while negative values suggest a downtrend. A CMF reading near zero signals balanced buying and selling pressure.

Solana Daily Analysis. Source: TradingView

As of this writing, the indicator’s reading is 0.23, suggesting that Solana is experiencing a surge in buying pressure. With support at $186.58, a new Solana all-time high could be close, and the price could rally beyond $260.

However, if selling pressure occurs, this prediction might be invalidated. In that scenario, SOL’s price might drop to $157.89.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Quant

Quant  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  KuCoin

KuCoin  Pyth Network

Pyth Network  NEXO

NEXO  Kaia

Kaia  Tezos

Tezos  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Zcash

Zcash  Eigenlayer

Eigenlayer  Jito

Jito  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  SPX6900

SPX6900  Popcat

Popcat  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  Synthetix Network

Synthetix Network  eCash

eCash  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  dYdX

dYdX  Amp

Amp  Axelar

Axelar  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Turbo

Turbo  Safe

Safe  Super OETH

Super OETH  Usual

Usual  Oasis

Oasis  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD