SUI Crypto Market Structure Back to Bullish: Is SUI Headed for $5 Now?

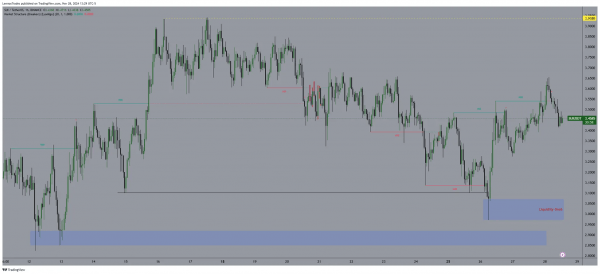

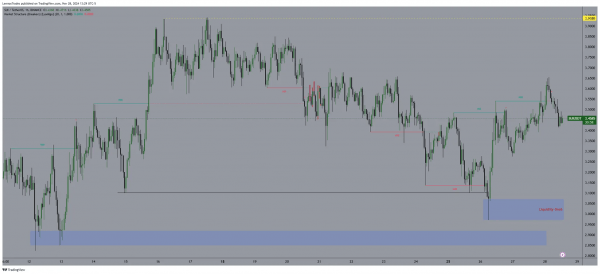

Sui crypto token reverted to a bullish setup with clear delineations of Market Structure Breaks (MSBs) after a sneaky liquidity grab.

The analysis revealed a bullish trend, indicated by the latest MSB, suggesting a potential rise in SUI prices towards the $5 mark.

SUI price found strong support around $3.00, marked by a deep liquidity grab area, suggesting accumulation before a price ascent.

— Advertisement —

Following this, the price trajectory formed two major MSBs, highlighting a shift from lower levels toward higher structural baselines.

Notably, the first MSB around $3.00 propelled the price upwards, setting a resistance-turned support level that held on subsequent tests.

SUI/USDT hourly chart | Source: Trading View

A second, higher MSB followed, pushing the price towards $3.50. Each MSB indicated a pivotal change where buying sentiment overcame selling pressure, potentially pointing to further upward movement.

— Advertisement —

If this level holds, it may confirm the bullish market structure and potentially lead to a further price increase towards $5. This is primarily because traders and investors could continue to show increased confidence in SUI’s market strength.

This setup provides a promising outlook for SUI, aligning with broader crypto market recoveries.

The Short Term Bubble Risk Signal Potential Upturn

Additionally, SUI’s Short Term Bubble Risk Indicator indicated a noteworthy phase in its market dynamics. It signaled a potential upturn following a cooling-off period.

The Short Term Bubble Risk Indicator quantified the potential overvaluation risk based on trading behavior and price spikes. It peaked above a value of 2, signifying an imminent bubble pop.

Historically, peaks correlated with the SUI crypto price approaching $2.00, followed by a sharp decline as the bubble indicator suggested excessive market hype.

Recently, the risk indicator receded below critical levels, now hovering around 2.06, indicating that the initial overvaluation concerns have subsided. This typically discourages speculative trading and stabilizes the price.

During this period, SUI retraced to a supportive $3 level, confirming the bubble pop and establishing a robust foundation for recovery.

SUI short-term bubble risk | Source: IntoTheCryptoverse

As the bubble risk diminished and market sentiment stabilized, SUI’s price exhibited resilience and potential for growth. The decreased risk levels suggested that SUI could be gearing up for a targeted run towards the $5 mark.

Such movements are often backed by renewed investor confidence and balanced market participation. They also lack the speculative frenzy indicated by prior high-risk levels.

This setup further meant that SUI was positioned for a possible bullish phase, provided the market maintains its current stability and investor interest continues to revive.

Sui Crypto Only 12.8% Down

Again, SUI crypto continued to show market resilience, as indicated by the recent analysis of its drawdown from the all-time high (ATH).

As of press time, SUI’s price was only 12.8% below its new peak of $3.9, signaling a robust bullish trend within the market.

This minimal drawdown highlighted its strong recovery momentum and potential for sustained growth. The past months illustrated a series of recoveries and corrections, with the drawdown reducing sharply in recent times for Sui crypto.

SUI percentage drawdown from ATH | Source: IntoTheCryptoverse

The pattern suggested that Sui crypto has not only recovered swiftly from dips but also managed to sustain near its ATH levels. The behavior was indicative of solid investor confidence and a bullish outlook among market participants.

Moreover, the drawdown chart aligned closely with the price line, reflecting that the price had been consistently near its upper levels, even with market fluctuations.

This stability near the ATH was a strong indicator of SUI’s potential to maintain or even exceed these levels moving forward.

The network’s performance, coupled with a reduced drawdown percentage, positioned Sui favorably in the crypto market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Sui

Sui  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  Virtuals Protocol

Virtuals Protocol  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Binance-Peg WETH

Binance-Peg WETH  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Gate

Gate  Quant

Quant  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  Pyth Network

Pyth Network  KuCoin

KuCoin  NEXO

NEXO  Tezos

Tezos  Kaia

Kaia  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Raydium

Raydium  Brett

Brett  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Arweave

Arweave  Core

Core  AIOZ Network

AIOZ Network  IOTA

IOTA  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Fartcoin

Fartcoin  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Pendle

Pendle  Zcash

Zcash  ApeCoin

ApeCoin  Jito

Jito  ether.fi Staked ETH

ether.fi Staked ETH  Mog Coin

Mog Coin  Akash Network

Akash Network  Eigenlayer

Eigenlayer  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Wormhole

Wormhole  Conflux

Conflux  USDD

USDD  Popcat

Popcat  Jupiter Staked SOL

Jupiter Staked SOL  Mina Protocol

Mina Protocol  Compound

Compound  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  SPX6900

SPX6900  Ronin

Ronin  SuperVerse

SuperVerse  PancakeSwap

PancakeSwap  eCash

eCash  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Synthetix Network

Synthetix Network  Gnosis

Gnosis  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  Chia

Chia  Axelar

Axelar  dYdX

dYdX  Amp

Amp  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Grass

Grass  Turbo

Turbo  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Super OETH

Super OETH  Safe

Safe  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Oasis

Oasis  Echelon Prime

Echelon Prime  Blur

Blur  Beldex

Beldex  1inch

1inch  Usual

Usual  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  DeXe

DeXe  Livepeer

Livepeer  pumpBTC

pumpBTC  Creditcoin

Creditcoin  APENFT

APENFT  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  TrueUSD

TrueUSD  Arkham

Arkham