Survey Unveils Volatility and Security Risks in Crypto Industry

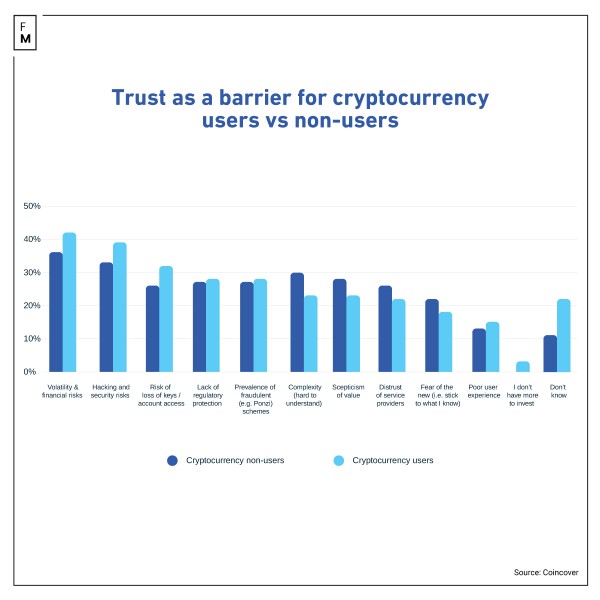

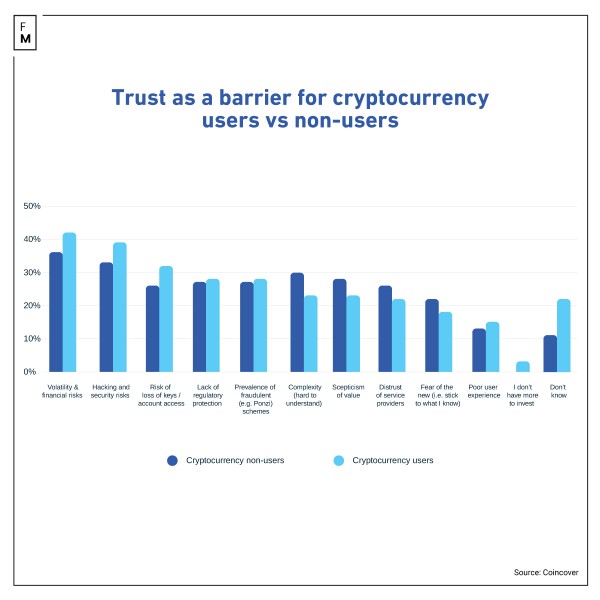

More than 40% of cryptocurrency users have expressed skepticism about cryptocurrencies due to concerns about their volatility and financial risks, according to a survey by Coincover. Cryptocurrencies have faced various challenges and controversies over the years, which have contributed to a mixed reputation. According to a survey by Coincover, some of the key challenges facing the cryptocurrency industry when it comes to improving its reputation and achieving mass adoption.

Survey Findings and Insights: Influences on Crypto Reputation

The report identifies two major obstacles to the mass adoption of cryptocurrencies, volatility and security risks. These are longstanding concerns within the crypto industry that have contributed to a lack of confidence among potential users. The report’s findings are based on a substantial survey of over 16,000 people across nine countries.

The current reputation is likely influenced by factors, such as market volatility, high-profile security breaches, regulatory uncertainty, and the association of cryptocurrencies with illegal activities.

To address these challenges, the report suggests the implementation of voluntary industry standards. These standards would serve as guidelines for cryptocurrency providers to enhance security, transparency, and accountability in their operations.

Additionally, the report proposes mechanisms for users to identify providers that adhere to these standards, which could help build trust and confidence among consumers.

Ian Taylor, the Head of Crypto and Digital Assets at KPMG and the Board Advisor at CryptoUK, added: “Self-regulation is something that we’ve been working on as a global industry for a long time to support government entities, as well as international standard setters that develop the frameworks that get passed down to individual competent authorities. In a new industry, that’s the first stepping stone to providing codes of conduct for members, and a set of rules that protects against harm to clients.”

Encouraging users to move to recognized providers who adhere to industry standards could help establish a more secure and reliable ecosystem. This would provide users with a clear way to distinguish between reputable and potentially risky cryptocurrency services.

Cryptocurrency Preference: Bitcoin, NFTs, and Ethereum

The survey indicates that a significant portion of respondents (17%) already own cryptocurrencies and an even larger percentage (30%) are considering investing in cryptocurrencies in the next 12 months.

This suggests a growing interest and the potential for increased adoption in the near future. Among those surveyed, Bitcoin is the most popular cryptocurrency, with 46% of respondents owning or considering it. Non-Fungible Tokens (NFTs) come in second place at 18%, which is ahead of Ethereum at 17%.

This reflects the diversity of interests within the cryptocurrency space. More than half of the respondents (55%) have expressed some level of curiosity about cryptocurrencies, indicating a growing awareness and willingness to explore this emerging asset class.

Additionally, 11% of respondents consider themselves actively or highly invested in the market, suggesting a dedicated and engaged user base.

Positive Financial Returns in Cryptocurrency

A significant portion of respondents (50%) report positive financial returns from their cryptocurrency holdings. This positive sentiment regarding returns is likely to encourage more individuals to consider cryptocurrencies as an investment option.

Overall, these findings suggest that cryptocurrencies are gaining traction and becoming increasingly mainstream. The high level of curiosity and interest, combined with positive investment returns for many, could drive further adoption and investment in the cryptocurrency space.

David Janczewski, the CEO and Co-Founder at Coincover, said: “Crypto’s potential is huge, but our research makes clear that the industry must take steps to address consumer concerns. Many still perceive cryptocurrency as a mysterious technology and the industry must show that it is doing everything it can to protect investors, build consumer confidence, and provide stronger foundations for the future.”

It’s essential for individuals to approach cryptocurrency investments with caution, conduct thorough research, and be aware of the inherent risks associated with this asset class.

Consumer Cynicism towards Cryptocurrencies

The obstacles and concerns outlined in the data provided highlight some of the challenges that the cryptocurrency industry must address to achieve broader adoption and improve its reputation. A significant portion of consumers (19%) expressed cynicism about cryptocurrencies, while 25% are entirely closed off to the idea.

Trust remains a significant issue, with 30% of non-crypto users expressing a complete lack of trust in cryptocurrency exchanges. The collapse of FTX (a famous cryptocurrency exchange) has had a negative impact on the industry’s reputation.

Cryptocurrency’s Association with Criminal Activities

The perception of cryptocurrencies as enablers of criminal activities is a persistent concern. Price volatility and security concerns are identified as the top barriers to cryptocurrency investment. Concerns related to fraud and theft, including hacking, are significant worries for cryptocurrency: Only 54% of people who own cryptocurrency assets are satisfied with their providers’ commitment to security.

Addressing these obstacles and concerns will require collaborative effort from the cryptocurrency industry, regulators, and educational institutions. Stricter regulations, industry best practices, enhanced security measures, and educational initiatives can help build a more trustworthy and secure environment for cryptocurrency users and investors.

Janczewski, said: “The industry can do more to protect users and reduce risk. We must develop clear standards and adopt best working practice principles. By so doing, we can reduce security risks, prevent reputational damage, and help to build confidence among users. Organisations which adhere to standards will become easily identifiable, and force out untrustworthy entities.”

The report’s recommendations align with the broader industry trend of improving security and transparency within the cryptocurrency space. By addressing these concerns and implementing voluntary standards, the crypto industry may be able to gradually enhance its reputation and pave the way for broader adoption among both individual users and institutional investors. However, the success of such initiatives will depend on widespread industry cooperation and regulatory support.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Render

Render  MANTRA

MANTRA  Bittensor

Bittensor  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena

Ethena  Dai

Dai  Arbitrum

Arbitrum  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Theta Network

Theta Network  Movement

Movement  Injective

Injective  The Graph

The Graph  dogwifhat

dogwifhat  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  JasmyCoin

JasmyCoin  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Gate

Gate  GALA

GALA  Lido DAO

Lido DAO  Mantle Staked Ether

Mantle Staked Ether  Tokenize Xchange

Tokenize Xchange  Lombard Staked BTC

Lombard Staked BTC  Beam

Beam  Maker

Maker  The Sandbox

The Sandbox  Pyth Network

Pyth Network  Usual USD

Usual USD  NEXO

NEXO  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Tezos

Tezos  Kaia

Kaia  KuCoin

KuCoin  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  IOTA

IOTA  Bitcoin SV

Bitcoin SV  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Curve DAO

Curve DAO  Marinade Staked SOL

Marinade Staked SOL  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Decentraland

Decentraland  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Pendle

Pendle  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Zcash

Zcash  Eigenlayer

Eigenlayer  Mog Coin

Mog Coin  Jito

Jito  Chiliz

Chiliz  Akash Network

Akash Network  ai16z

ai16z  Conflux

Conflux  Wormhole

Wormhole  Popcat

Popcat  Mina Protocol

Mina Protocol  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Jupiter Staked SOL

Jupiter Staked SOL  USDD

USDD  Compound

Compound  Ronin

Ronin  SuperVerse

SuperVerse  SPX6900

SPX6900  PancakeSwap

PancakeSwap  Synthetix Network

Synthetix Network  eCash

eCash  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Chia

Chia  dYdX

dYdX  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Amp

Amp  Peanut the Squirrel

Peanut the Squirrel  Axelar

Axelar  ZKsync

ZKsync  Notcoin

Notcoin  Ether.fi Staked BTC

Ether.fi Staked BTC  CHEX Token

CHEX Token  LayerZero

LayerZero  Tether Gold

Tether Gold  Baby Doge Coin

Baby Doge Coin  Mantle Restaked ETH

Mantle Restaked ETH  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Vana

Vana  Turbo

Turbo  Usual

Usual  Oasis

Oasis  Blur

Blur  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Safe

Safe  1inch

1inch  Super OETH

Super OETH  Echelon Prime

Echelon Prime  Trust Wallet

Trust Wallet  Goatseus Maximus

Goatseus Maximus  Creditcoin

Creditcoin  Beldex

Beldex  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  sUSDS

sUSDS  PayPal USD

PayPal USD  Livepeer

Livepeer  APENFT

APENFT  PAX Gold

PAX Gold  Gigachad

Gigachad  pumpBTC

pumpBTC  Kusama

Kusama  Arkham

Arkham  Nervos Network

Nervos Network  DeXe

DeXe  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)