What If Altcoin Season Never Comes? Analyst Warns It’s Possible

Duo Nine, a prominent crypto educator and analyst, posed a question no one wants to hear. “What if altcoin season never comes?,” he asked, with multiple data to back his rhetoric.

An altcoin season is an informal term describing a phase where investing in altcoins provides better returns than pouring capital into Bitcoin (BTC).

Analyst Explains Altcoin Season Delay

After the fourth Bitcoin halving, the crypto market’s next major focus, aside from Ethereum ETFs (exchange-traded funds) approvals and launches, was the anticipation of an altcoin season. Several key events typically lead up to this phase.

First, fresh capital enters the cryptocurrency market, initially flowing into stablecoins, Bitcoin, or Ethereum. These assets are prioritized due to their perceived stability compared to smaller market cap cryptocurrencies. Next, this influx of capital triggers a market rally.

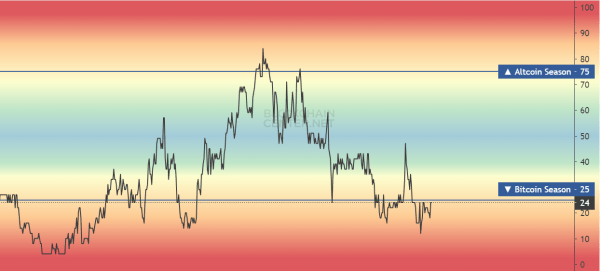

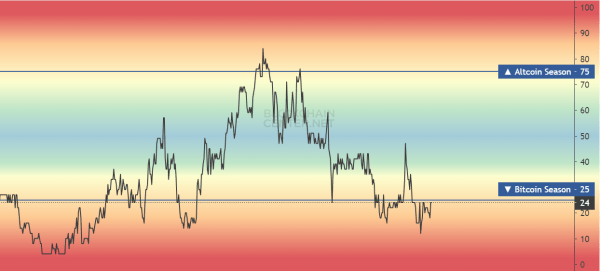

Altcoin Season Index. Source: blockchaincenter.net

Finally, profits from these assets, along with additional capital, begin to flow into altcoins. This capital rotation is what sets off an altcoin season. According to the altcoin season index, the crypto markets are currently still in the Bitcoin season.

Negative Flows for Ethereum ETFs

Duo Nine outlines a scenario where the sequence leading to an altcoin season hasn’t fully materialized. He suggests that investing entirely in altcoins might be problematic, pointing to negative flows for Ethereum ETFs as a concerning sign.

“Since January 2024, the Bitcoin ETFs managed to attract over $17 billion in net investments after Grayscale sales. Ethereum’s ETF went live in July. Net balance on that? -$406 million,” the analyst wrote.

Bitcoin, Ethereum ETF Inflows 2024. Source: X/Duo Nine

The negative flows for Ethereum ETFs come amid ongoing Grayscale customer redemptions following the conversion of its trust to ETFs. Before the approval of spot ETFs, the Grayscale Bitcoin Trust (GBTC) was allowing investors to redeem shares for value in US dollars. Now, with BTC and ETH ETFs available, customers are opting to redeem their shares by selling Bitcoin and Ethereum, contributing to the negative flows.

Per the analyst, while Grayscale’s customers sold $2.3 billion in ETH since July, ETF buy pressure has not been enough to offset this sell-off. Duo Nine sees no difference for an altcoin season if a Solana ETF launches.

However, it’s important to recognize that the ETH ETF market is still in its early stages. Given this context, it’s crucial to understand that while the short-term outlook for spot Ethereum ETFs may be bearish, the mid- and long-term prospects remain bullish.

In hindsight, it took some time before Bitcoin rallied following spot BTC ETF launches on January 11. The pioneer crypto chopped horizontally for slightly over a month before extending north.

“The reason that investor buying of the new Bitcoin ETFs isn’t pushing up the price of Bitcoin is that the outflows from GBTC plus selling of BTC exceed the combined inflows into all of the other ten Bitcoin ETFs. Once the initial ETF demand wanes, I expect a bigger price drop,” economist Peter Schiff said at the time.

Since the launch of Ethereum ETFs on July 23, barely a month has passed, leaving ETH with ample time for price discovery. Once Grayscale customer redemptions ease, ETH ETF flows could stabilize in the positive, with capital inflows into Ethereum rotating into altcoins.

Bitcoin Dominance Breakout

The analyst also bases his ‘no altcoin season’ thesis on the breakout seen in the Bitcoin dominance chart. This means BTC outperforms altcoins, suggesting a lack of confidence in the latter. Based on CoinGecko data, BTC dominance currently sits at 53.8%.

This turnout is likely ascribed to prevailing market uncertainty amid global geopolitical tension, political frenzy in the US, and recession fears, among other volatility-inducing narratives. These prompt investors to rally behind Bitcoin, a flight to safety, as BTC is considered a better haven than altcoins.

Nevertheless, some investors view high Bitcoin dominance as an opportunity to accumulate altcoins at lower prices. When Bitcoin’s dominance is high, altcoins may be undervalued relative to Bitcoin, presenting a buying opportunity for those who believe in the long-term potential of specific altcoins.

Bitcoin Dominance Chart. Source: X/Duo Nine

Based on the chart above, while Bitcoin dominance continues to rise, it approaches critical resistance, which could see altcoins make headway. However, amid the skepticism for an altcoin season, some say even if it does come, it may fail to be as rigorous as that of 2017 and 2020.

“This narrative comes every cycle by Bitcoin maxis and never worked. Eventually, a portion of the bitcoin supply flows into ALTs when the dominance starts plummeting. There comes a time when dominance goes below 45% and it would happen this cycle as well,” another X user added.

Altcoin season delays notwithstanding, analysts are already watching some altcoins this month, with some rekindling hope that delay may not necessarily mean total absence.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Gate

Gate  Quant

Quant  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  Pyth Network

Pyth Network  KuCoin

KuCoin  NEXO

NEXO  Tezos

Tezos  Kaia

Kaia  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Arweave

Arweave  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Decentraland

Decentraland  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Pendle

Pendle  Zcash

Zcash  ApeCoin

ApeCoin  Fartcoin

Fartcoin  ether.fi Staked ETH

ether.fi Staked ETH  Jito

Jito  Eigenlayer

Eigenlayer  Mog Coin

Mog Coin  Chiliz

Chiliz  Akash Network

Akash Network  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  Popcat

Popcat  SPX6900

SPX6900  Mina Protocol

Mina Protocol  Jupiter Staked SOL

Jupiter Staked SOL  Compound

Compound  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  SuperVerse

SuperVerse  PancakeSwap

PancakeSwap  Ronin

Ronin  eCash

eCash  Synthetix Network

Synthetix Network  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  Amp

Amp  Axelar

Axelar  dYdX

dYdX  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  Terra Luna Classic

Terra Luna Classic  CHEX Token

CHEX Token  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Turbo

Turbo  Vana

Vana  Safe

Safe  Super OETH

Super OETH  cat in a dogs world

cat in a dogs world  Oasis

Oasis  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  Usual

Usual  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD