A Bitcoin Maximalist’s Ode To Ordinals

This is an opinion editorial by L. Asher Corson, a partner at UTXO Management.

As a Bitcoin Maximalist, I love Ordinals. Other Maximalists should also consider loving Ordinals, as they demonstrate Bitcoin’s superiority in ways not previously possible. Ordinals enable functionalities that undermine the need for other blockchains to even exist. The use cases that were demonstrated on other blockchains are now possible natively on Bitcoin. Despite Bitcoin’s strengthening position, some self-proclaimed Maximalists on X (formerly Twitter) bizarrely celebrated decreased network fees and declared Ordinals to have failed. This seemingly implies that Bitcoin might somehow benefit from a failure of the Ordinals protocol and lower miner earnings. But Ordinals haven’t failed and the interest isn’t nearly over. To the contrary, trading volume across digital artifacts, unique satoshis and BRC-20 tokens has been historic. According to cryptoslam which tracks on-chain NFT volume, Ordinals have done over $500 million of trading volume since they were launched at the beginning of 2023. Despite volume and prices being down currently, investors in the ecosystem are writing big checks to Ordinals companies. Xverse, an Ordinals wallet, just raised 5 million dollars on a 50 million dollar valuation from some of the most sophisticated investors in the ecosystem. It’s far more likely we are at the beginning of this phenomenon than the end.

What are Ordinals? It is a protocol developed by Casey Rodarmor (@rodarmor) that enables any data to be included in a Bitcoin transaction. It uses Ordinal Theory to associate that data with a specific satoshi (the smallest unit of Bitcoin) which can be owned and traded. This innovation enables the creation and trading of digital assets directly on the Bitcoin blockchain without a peg or a bridge.

Bitcoin Maximalists understand that there have never been serious contenders to replace bitcoin as digital money, and it’s unlikely any will ever emerge. Viable altcoin use cases have never been based on having better monetary properties than bitcoin because that really isn’t possible. Absolute digital scarcity is unlikely to be discovered again because the circumstances surrounding Bitcoin’s creation were so unique, in part, because today’s government understands the risks of letting a decentralized network grow too large and they won’t let it happen again.

On the other hand, viable altcoin use cases are related to features that Bitcoin couldn’t previously support. Some of those use cases that the market has indisputably embraced include: decentralized trading, non-fungible tokens (NFTs), stablecoins, capital formation, borrowing/lending and on-chain leverage. Uniswap, a decentralized exchange, has done almost $500 billion in trading volume since it was launched in 2018. Additionally, Ethereum has done $43.6 billion in NFT trading volume, according to CryptoSlam!. Source: CryptoSlam! NFT data, rankings, prices, sales volume charts, market cap

Although many don’t like it, these use cases will exist somewhere because the market has an appetite for them. My strong preference is that they exist primarily on Bitcoin and not on other chains. It would certainly be better for Bitcoin and the effort to separate money and state, if there were not so many competing chains soaking up market share. Ordinals have the potential to not only enable these use cases to be built natively on Bitcoin, but also to surpass their altcoin versions in terms of implementation. These would be better built on Bitcoin because the protocol itself is more decentralized and secure than altcoins. Bitcoin has the largest market capitalization compared to all the other chains that can support the development of these use cases. But also better because these use cases will be tailored to the Bitcoin community and will therefore embody Bitcoin ideals of decentralization, immutability and permissionlessness.

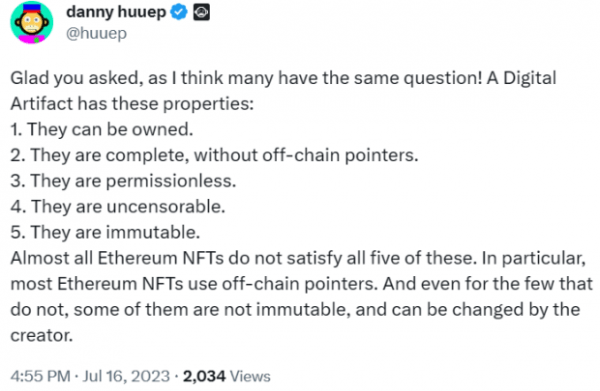

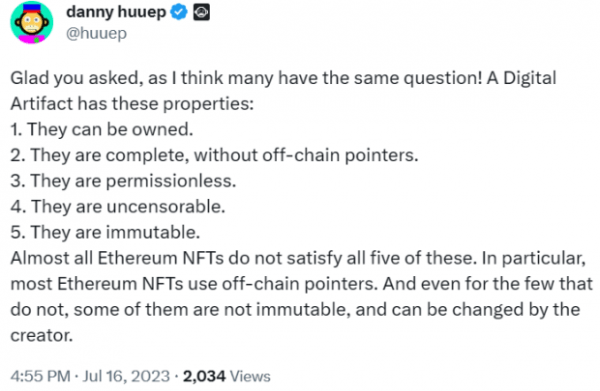

Although the protocol itself can’t stop scams, Rodarmor purposefully built Ordinals with Bitcoin ideals at the forefront of his design decisions. For example, the Ordinals implementation of digital artifacts is objectively superior to the way almost all NFTs were implemented on Ethereum and other chains. Danny Huuep describes the properties of a digital artifact, all of which Ordinals meet, extremely well:

Source: X

Imagine a piece of digital art worth $1 million, or imagine politically sensitive information like classified documents that detail government atrocities. Should these valuable or sensitive assets be distributed using technology that can easily disappear or that can be easily changed? The answer is obviously no. It’s also somewhat obvious that over time, the best artists, developers , activists, and investors will gravitate towards technology with stronger immutability that is capable of protecting their creation, information, or investment for hundreds or even thousands of years. In the case of digital art specifically, they will migrate to digital artifacts on Bitcoin that store the actual artwork, instead of NFTs that just point to where it’s stored on an off-chain server that could go down at any time.

Bitcoin stands alone atop the world of digital money, and the rise of Ordinals only cements that standing. This is not just about the idea of Bitcoin dominance in market capitalization terms, but the sheer dominance of Bitcoin’s principles and the vast potential of its immutable blockchain. With Ordinals unlocking unprecedented opportunities within the Bitcoin ecosystem, I see a seismic shift on the horizon. This shift should make Maximalists smile.

This is a guest post by L. Asher Corson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Disclosure: L. Asher Corson is a partner at UTXO Management, subsidiary of BTC Inc., the parent company of Bitcoin Magazine

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Polygon

Polygon  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stellar

Stellar  Monero

Monero  Stacks

Stacks  Mantle

Mantle  Filecoin

Filecoin  Render

Render  dogwifhat

dogwifhat  Injective

Injective  Bittensor

Bittensor  OKB

OKB  Hedera

Hedera  Cronos

Cronos  Maker

Maker  Immutable

Immutable  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  First Digital USD

First Digital USD  Bonk

Bonk  Arweave

Arweave  Sui

Sui  Optimism

Optimism  The Graph

The Graph  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  THORChain

THORChain  Mantle Staked Ether

Mantle Staked Ether  Theta Network

Theta Network  WhiteBIT Coin

WhiteBIT Coin  Notcoin

Notcoin  Aave

Aave  Jupiter

Jupiter  Ondo

Ondo  Pyth Network

Pyth Network  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  Fantom

Fantom  Brett

Brett  Core

Core  Celestia

Celestia  Algorand

Algorand  Sei

Sei  ether.fi Staked ETH

ether.fi Staked ETH  Quant

Quant  Flow

Flow  Gate

Gate  MANTRA

MANTRA  Marinade Staked SOL

Marinade Staked SOL  Popcat

Popcat  KuCoin

KuCoin  Beam

Beam  MultiversX

MultiversX  Bitcoin SV

Bitcoin SV  Axie Infinity

Axie Infinity  Helium

Helium  GALA

GALA  Ethereum Name Service

Ethereum Name Service  BitTorrent

BitTorrent  EOS

EOS  Tokenize Xchange

Tokenize Xchange  NEO

NEO  ORDI

ORDI  Akash Network

Akash Network  dYdX

dYdX  Ethena

Ethena  Tezos

Tezos  eCash

eCash  The Sandbox

The Sandbox  USDD

USDD  Conflux

Conflux  cat in a dogs world

cat in a dogs world  Worldcoin

Worldcoin  Ronin

Ronin  Starknet

Starknet  SATS (Ordinals)

SATS (Ordinals)  NEXO

NEXO  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Decentraland

Decentraland  Raydium

Raydium  Chiliz

Chiliz  Pendle

Pendle  PayPal USD

PayPal USD  BOOK OF MEME

BOOK OF MEME  Mog Coin

Mog Coin  Mina Protocol

Mina Protocol  AIOZ Network

AIOZ Network  Oasis Network

Oasis Network  Tether Gold

Tether Gold  ZKsync

ZKsync  Synthetix Network

Synthetix Network  Gnosis

Gnosis  IOTA

IOTA  Nervos Network

Nervos Network  DeXe

DeXe  Swell Ethereum

Swell Ethereum  Klaytn

Klaytn  Astar

Astar  ApeCoin

ApeCoin  Wormhole

Wormhole  LayerZero

LayerZero  Aerodrome Finance

Aerodrome Finance  Livepeer

Livepeer  Safe

Safe  TrueUSD

TrueUSD  Axelar

Axelar  Zcash

Zcash  1inch

1inch  Terra Luna Classic

Terra Luna Classic  Bitcoin Gold

Bitcoin Gold  Kava

Kava  PancakeSwap

PancakeSwap  Theta Fuel

Theta Fuel  Aevo

Aevo  Illuvium

Illuvium  PAX Gold

PAX Gold  Trust Wallet

Trust Wallet  APENFT

APENFT  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  IoTeX

IoTeX  WEMIX

WEMIX  Turbo

Turbo  ConstitutionDAO

ConstitutionDAO  H2O Dao

H2O Dao  MX

MX  Jito

Jito  Gravity

Gravity  WOO

WOO  Galxe

Galxe  Stader ETHx

Stader ETHx  Ether.fi

Ether.fi  SafePal

SafePal  Manta Network

Manta Network  Compound

Compound  Memecoin

Memecoin  Arkham

Arkham  GMT

GMT  cETH

cETH  SuperVerse

SuperVerse  SingularityNET

SingularityNET  Golem

Golem  Rocket Pool

Rocket Pool  Dymension

Dymension  0x Protocol

0x Protocol  Blur

Blur  Kusama

Kusama  Avail

Avail  Osmosis

Osmosis  PONKE

PONKE  Zilliqa

Zilliqa  Beldex

Beldex  AltLayer

AltLayer  Dash

Dash  Echelon Prime

Echelon Prime  Curve DAO

Curve DAO  CorgiAI

CorgiAI  Enjin Coin

Enjin Coin