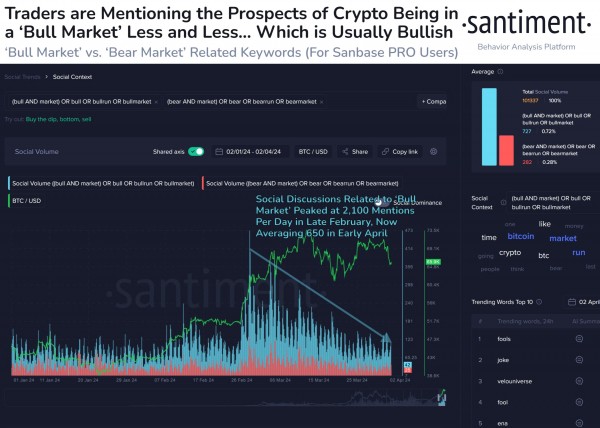

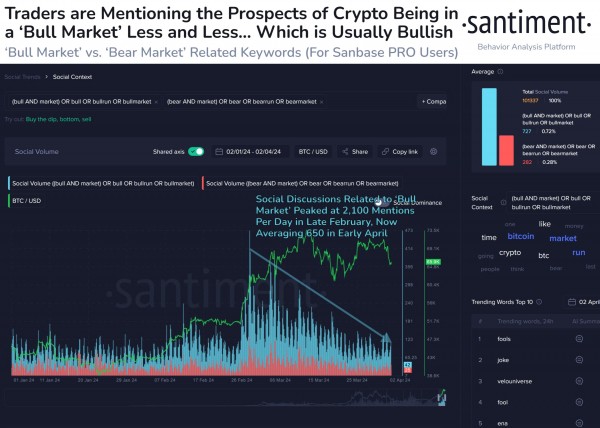

Bitcoin Flashing a Bullish Signal Due to This Historical Factor, According to Analytics Firm Santiment

Bitcoin (BTC) is flashing a bullish signal based on one historical factor, according to market intelligence platform Santiment.

In a new thread, the crypto analytics firm says that it appears as if the top crypto asset by market cap is losing momentum after skyrocketing nearly 150% since October.

However, Santiment notes that historically, the more people are worried about BTC in the long term, the higher the chances are of a continued market rise.

“Is crypto still in a bull market after Bitcoin’s +144% price return since October 15th? Well, according to the crowd, the belief has fizzled out significantly. Historically, less long-term optimism increases the probability of a continued market rise.”

Source: Santiment/X

Because of the crowd’s shifting BTC outlook, Santiment says that Bitcoin bulls should be rooting for market sentiment to remain bearish.

“The crowd’s sentiment toward Bitcoin and crypto markets in general has wavered ever since the big correction three weeks ago. Even with the BTC halving now just two weeks away, trader sentiment reflects FUD (fear, uncertainty and doubt) and bearish expectations.

With prices bouncing back to $69,000 temporarily on Thursday, bulls should be rooting for the general consensus to remain negative. Historically, markets move the opposite direction of the crowd’s expectation, so some of the best times to buy are during times in which most don’t believe a rally can start or continue.”

Source: Santiment/X

Santiment goes on to say that the market believes BTC’s latest dip was due to the government selling the 10,000 BTC seized from the defunct online black marketplace Silk Road. The crypto analytics firm says that spikes in BTC’s price tend to happen when the crowd becomes concerned about the seized Silk Road Bitcoin stack.

“Bitcoin has bounced all the way back above $69,000 after dropping below $65,000 just two days ago. The culprit of the fall, according to most of the crypto community, is attributed to the US government authorities’ admission to selling nearly 10,000 BTC from the Silk Road seizure.

There are expected to be four more similar-sized selloffs throughout 2024, which has evoked major fear from traders. As we can see, there have been two major spikes in crowd interest related to Silk Road in 2024, and both of them foreshadowed nearly instant crypto market spikes immediately afterward.

Markets typically move the opposite direction of the crowd’s expectation, so if fear continues, expect further price rises.”

Source: Santiment/X

Bitcoin is trading for $67,905 at time of writing, a marginal decrease during the last day.

Generated Image: Midjourney

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena

Ethena  Arbitrum

Arbitrum  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Immutable

Immutable  Bonk

Bonk  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  The Graph

The Graph  Coinbase Wrapped BTC

Coinbase Wrapped BTC  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Gate

Gate  JasmyCoin

JasmyCoin  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  Tokenize Xchange

Tokenize Xchange  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  Pyth Network

Pyth Network  KuCoin

KuCoin  NEXO

NEXO  Kaia

Kaia  Tezos

Tezos  Brett

Brett  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  dYdX

dYdX  AIOZ Network

AIOZ Network  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Decentraland

Decentraland  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  Zcash

Zcash  ApeCoin

ApeCoin  Eigenlayer

Eigenlayer  Jito

Jito  Fartcoin

Fartcoin  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ai16z

ai16z  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  Popcat

Popcat  Mina Protocol

Mina Protocol  Jupiter Staked SOL

Jupiter Staked SOL  SPX6900

SPX6900  Compound

Compound  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  SuperVerse

SuperVerse  PancakeSwap

PancakeSwap  eCash

eCash  Synthetix Network

Synthetix Network  Gnosis

Gnosis  Chia

Chia  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Ether.fi Staked BTC

Ether.fi Staked BTC  Amp

Amp  ZKsync

ZKsync  dYdX

dYdX  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Axelar

Axelar  Notcoin

Notcoin  Tether Gold

Tether Gold  CHEX Token

CHEX Token  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Usual

Usual  Grass

Grass  Baby Doge Coin

Baby Doge Coin  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Turbo

Turbo  Vana

Vana  Super OETH

Super OETH  Safe

Safe  cat in a dogs world

cat in a dogs world  Echelon Prime

Echelon Prime  ORDI

ORDI  Oasis

Oasis  Blur

Blur  1inch

1inch  Trust Wallet

Trust Wallet  Beldex

Beldex  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  DeXe

DeXe  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  Arkham

Arkham  TrueUSD

TrueUSD  Kusama

Kusama