Bitcoin on the Brink: Taproot Wizard Calls for Action, Taaki Demands Core Disbandment

Lately, there’s been a whirlwind of chat about Bitcoin’s consensus tweaks, Core developers, and the Lightning Network. This week, Taproot Wizard Eric Wall made a bold claim: BTC has one last shot to beef up its features beyond just being digital gold, or it might fade into obscurity as a peer-to-peer currency.

Taproot Wizard Says Bitcoin Has ‘One Last Shot’ Before Irrelevance

There’s been heaps of talk recently about whether BTC truly functions as a peer-to-peer electronic cash system or if there’s a central authority among Bitcoin Core developers. Just two days ago, Bitcoin.com News dished out the scoop on Amir Taaki blasting the leadership of the top crypto asset, explaining his jump to other crypto networks and privacy tech. In his thread, Taaki tipped his hat to a fresh crew of bitcoiners who are pushing to make BTC even better.

On Dec. 16, Taproot Wizard Eric Wall took to X and noted that there needs to be immediate action to unlock Bitcoin’s full potential, emphasizing the current momentum and broad developer consensus on implementing covenants through a soft fork. “We have one last shot at inserting new functionality into bitcoin before all of us, every last soul, will become the remnants of an ‘early bitcoin fan club’ that no one cares about anymore,” Wall stated.

He added:

If we do not take this shot, this is where the story ends. bitcoin as digital gold, impotent as p2p money, in the best case funnelled around the web through hosted centralized service providers with no privacy, too tricky to self custody for normies.

While Wall argued that “replacing gold is cute,” he emphasized the need for innovations like channel-less Lightning, secure custody vaults, and privacy-focused second layers. This shift, the Taproot Wizard member contends, could expand Bitcoin’s target market from $17 trillion as digital gold to $170 trillion as universal hard money.

“This decision is yours. we need to oil the softforking machinery before it becomes completely stale and stuck in its tracks,” Wall detailed. ”We have momentum now. we have near-universal developer consensus on covenants as the next [soft fork]. We just have to agree on the last specifics.” Wall’s X post concluded by saying:

Bitcoin is the most important asset in crypto, and the most important project you’ve dedicated yourself to in your life. the time to act is now. one last ride for the Rohirrim. Now for ruin, now for wrath, and a red dawn.

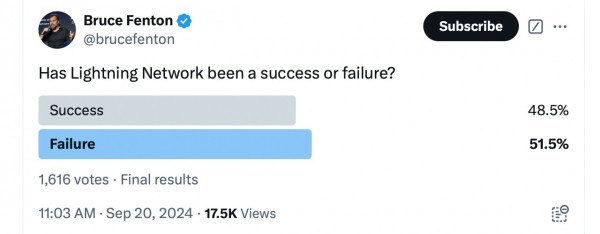

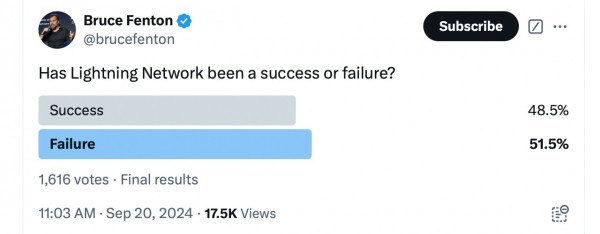

After Eric Wall dropped his post on X, Taaki didn’t miss a beat, firing back at the Taproot Wizard’s statement. “This is the truth. The Core team wanted time to try Lightning Network. It was complex and took a lot of work. It failed,” Taaki explained. “Now they should step aside and disband. Make Bitcoin a neutral standard. Allow client competition. No more Core monopoly. Just the free market.”

These chats have ignited a storm of criticism aimed at the Lightning Network. Loads of folks were totally on board with Taaki’s take. “Lightning was essentially a failed experiment, people have been at it for basically a decade and it has failed,” an X account called Dr. Nick wrote. “It’s unstable to the point of basically never working and there’s more liquidity in a single Binance Smartchain shitcoin farm than the entire lightning network.”

Even several bitcoiners told Taaki to use a custodial Lightning Network solution. “Bitcoiners telling me I should use a custodial lightning wallet now,” Taaki wrote. “Telling me I’m bad cos I used the wrong custodial wallet after getting rugged. Can’t make this up. Insane.”

Bitcoin’s evolution hangs in the balance as discussions intensify over its core direction. With several voices like Eric Wall advocating immediate innovation and others like Amir Taaki questioning leadership, the network’s ability to adapt will determine its survival. Whether it thrives as peer-to-peer money or lingers as digital gold, Bitcoin’s future will hinge on a community willing to embrace transformation.

The unfolding debate underscores a critical juncture for Bitcoin’s social contract. Innovation and decentralization remain the pillars of its appeal, yet internal friction may fracture its trajectory. If momentum is lost, Bitcoin risks obsolescence—a stark contrast to the groundbreaking promise it once represented. Only decisive consensus will ensure its relevance for generations yet to come.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Quant

Quant  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  KuCoin

KuCoin  Pyth Network

Pyth Network  NEXO

NEXO  Kaia

Kaia  Tezos

Tezos  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Zcash

Zcash  Eigenlayer

Eigenlayer  Jito

Jito  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  SPX6900

SPX6900  Popcat

Popcat  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  Synthetix Network

Synthetix Network  eCash

eCash  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  dYdX

dYdX  Amp

Amp  Axelar

Axelar  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Turbo

Turbo  Safe

Safe  Super OETH

Super OETH  Usual

Usual  Oasis

Oasis  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD