Bitcoin Price Tumbles Below $66,000: 4 Major Reasons

The Bitcoin market has witnessed a significant downturn, with prices plummeting below the $66,000 mark. This abrupt -5.6% price movement can be attributed to four major factors: a long liquidation event, a rising US Dollar Index (DXY), profit-taking by investors, and spot Bitcoin ETF outflows.

#1 Long Liquidations

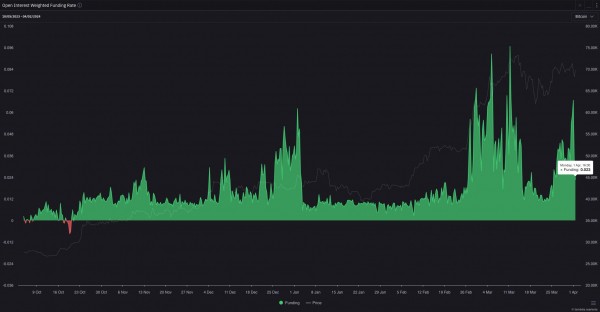

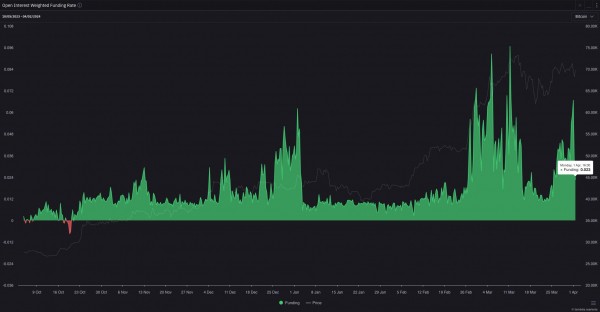

The main force leading to today’s downturn in Bitcoin’s price was a significant deleveraging event characterized by an unusually high level of long liquidations. Before the downturn, Bitcoin’s Open Interest (OI) Weighted Funding Rate was unusually high, indicating that leveraged traders were paying premiums to maintain long positions in anticipation of future price increases. This optimism, however, made the market vulnerable to sudden corrections.

Related Reading: Hedge Fund Manager Predicts When Bitcoin Price Will Reach $150,000

Crypto analyst Ted, known as @tedtalksmacro on X (formerly Twitter), remarked, “Today was the largest long liquidation event since the 19th March.” He further elaborated on the effects of this correction by noting, “Nice reset in overall positioning today, even on just a 5% drop lower for Bitcoin… Next leg higher is loading I think.” This comment highlights the severity of the liquidations and suggests a potential rebound or restructuring within the market as it stabilizes.

Coinglass data reveals that over the last 24 hours, 120,569 traders were liquidated, amounting to $395.53 million in total liquidations, with $311.97 million being long positions. Bitcoin-specific long liquidations were at $87.42 million.

#2 DXY Puts Pressure On Bitcoin

With 105.037, the DXY closed at its highest level since November yesterday, evidencing a strengthening US dollar. Given Bitcoin’s inverse correlation with the DXY, the stronger dollar might have shifted investor preference towards safer assets, moving away from riskier investments like Bitcoin.

This correlation stems from the global market’s risk sentiment, where a rising DXY often signals a shift towards safer investments, detracting from riskier assets like Bitcoin. However, analyst Coosh Alemzadeh provided a counter perspective, suggesting through a Wyckoff redistribution schema that despite the DXY’s recent uptick, the next move could favor risk assets, potentially including Bitcoin.

#DXY ⬆️4 weeks in a row/broke out of its downtrend so consensus is that a new uptrend is starting yet risk assets are consolidating at ATH

Next move ⬆️in risk assets on deck IMO pic.twitter.com/u6ORa76vkj

— “Coosh” Alemzadeh (@AlemzadehC) April 2, 2024

#3 Profit Taking By Investors

Profit-taking by investors has also played a significant role in the recent price adjustments. The Bitcoin on-chain analysis platform Checkonchain reported a spike in profit-taking activities.

Related Reading: Start Selling Bitcoin When This Happens, This Quant Says

Glassnode’s lead on-chain analyst, Checkmatey, shared insights via X, stating, “The classic Bitcoin MVRV Ratio hits conditions we characterize as ‘heated, but not yet overcooked’. MVRV = above +0.5sd but below +1sd. This indicates that the average BTC holder is sitting on a significant unrealized profit, prompting an uptick in spending.”

The profit-taking coincided with Bitcoin reaching a peak of $73,000, marking a cycle high in profit realization with over 352,000 BTC sold for profit. This selling behavior is typical in bull markets but plays a crucial role in creating resistance levels at local price tops.

#4 Bitcoin ETF Outflows

Lastly, the market witnessed notable outflows from Bitcoin ETFs, marking a reversal from last week’s substantial inflows. The total outflows amounted to $85.7 million in a single day, with Grayscale’s GBTC experiencing the most significant withdrawal of $302 million.

Meanwhile, Blackrock’s IBIT and Fidelity’s FBTC reported positive inflows, totaling $165.9 million and $44 million, respectively. Commenting on this, WhalePanda remarked, “Overall negative day but not as negative as the price implied. Closing of Q1 so taking profit here makes sense. Some fuckery around [the] new quarter and halving is to be expected.”

At press time, BTC traded at $66,647.

Featured image created with DALL·E, chart from TradingView.com Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Quant

Quant  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  KuCoin

KuCoin  Pyth Network

Pyth Network  NEXO

NEXO  Kaia

Kaia  Tezos

Tezos  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Zcash

Zcash  Eigenlayer

Eigenlayer  Jito

Jito  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  SPX6900

SPX6900  Popcat

Popcat  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  Synthetix Network

Synthetix Network  eCash

eCash  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  dYdX

dYdX  Amp

Amp  Axelar

Axelar  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Turbo

Turbo  Safe

Safe  Super OETH

Super OETH  Usual

Usual  Oasis

Oasis  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD