Bitcoin’s Bull Run Ignites: Traders Target $80,000 In High-Stakes Options Frenzy

As Bitcoin breached the $52,000 mark, a notable shift in investor sentiment has been observed, with an increased interest in call options for Bitcoin at ‘ambitious’ strike prices. This trend, primarily focusing on strikes above $60,000, signals a ‘robust’ confidence among traders in Bitcoin’s potential for further gains.

QCP Capital, a renowned crypto asset trading firm, explained this phenomenon in its latest report, emphasizing the concentrated buying activity in these high-strike call options with various expiry dates.

Related Reading: $52,000 And Climbing: Bitcoin Eyes New Highs This March, Predicts Top Firm

A Surge In High-Strike Call Options

Call options are financial contracts that give the buyer the right, but not the obligation, to buy an asset at a predetermined price within a specified timeframe.

In the context of Bitcoin, this surge in call option buying at higher strike prices suggests a bullish outlook from investors, betting on Bitcoin’s price to climb significantly higher than its current levels.

This optimism is not just a speculative bubble but is backed by substantial financial commitments, with QCP Capital highlighting close to “$10 million spent on premiums for $60,000 and $80,000” strike options alone.

According to the detailed analysis by QCP Capital, there’s been a significant uptick in the purchase of Bitcoin call options, with strike prices towering above $60,000. This activity is spread from April to December expiries, indicating a long-term bullish sentiment among investors.

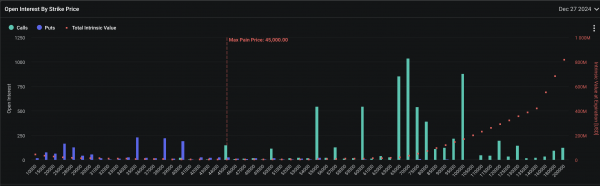

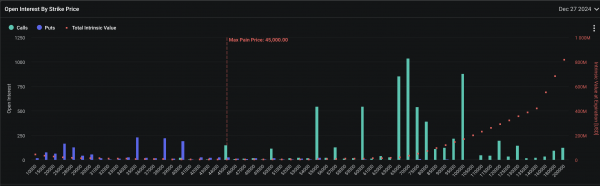

Deribit, the leading crypto derivatives exchange, corroborates this trend, reporting a substantial concentration of open call options at $65,000 and higher.

The December expiry call option cluster targets a $100,000 strike price, showcasing some traders’ ultra-bullish expectations for Bitcoin’s year-end valuation.

The end of March sees the largest volume of Bitcoin options calls at a $60,000 strike, revealing the immediacy of some traders’ bullish outlooks. With over 1,273 contracts set for the March 29 expiry, the notional value of these bets exceeds $67 million, highlighting the significant capital being placed on these optimistic market predictions.

Bitcoin Market Sentiment And Predictions

This enthusiastic options trading activity occurs amid bullish Bitcoin price forecasts. Matt Dines, Chief Investment Officer at Build Asset Management, identifies a ‘Cup and Handle’ pattern on the Bitcoin price chart, suggesting a potential rally to $75,000.

Cup and handle #Bitcoin #sendit pic.twitter.com/DmYAVwmLfj

— Matt Dines (@BuildCIO) February 13, 2024

Similarly, QCP Capital analysts see Bitcoin reaching new all-time highs, projecting a significant surge before the end of March 2024.

This collective optimism is also mirrored in the Ethereum market, where there’s a notable accumulation of call options around the $4,000 strike price for mid-year expiries, indicating a broader positive sentiment across major cryptocurrencies.

Related Reading: Betting Big On Ethereum: Options Traders Target $4,000 Mark Amid Market Optimism

Meanwhile, Bitcoin continues to make significant moves, crossing the $52,000 threshold with a nearly 20% increase in the past week, indicating that the market’s bullish sentiment is palpable.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Render

Render  MANTRA

MANTRA  Bittensor

Bittensor  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena

Ethena  Dai

Dai  Arbitrum

Arbitrum  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Theta Network

Theta Network  Movement

Movement  Injective

Injective  The Graph

The Graph  dogwifhat

dogwifhat  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  JasmyCoin

JasmyCoin  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Gate

Gate  GALA

GALA  Lido DAO

Lido DAO  Mantle Staked Ether

Mantle Staked Ether  Tokenize Xchange

Tokenize Xchange  Lombard Staked BTC

Lombard Staked BTC  Beam

Beam  Maker

Maker  The Sandbox

The Sandbox  Pyth Network

Pyth Network  Usual USD

Usual USD  NEXO

NEXO  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Tezos

Tezos  Kaia

Kaia  KuCoin

KuCoin  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  IOTA

IOTA  Bitcoin SV

Bitcoin SV  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Curve DAO

Curve DAO  Marinade Staked SOL

Marinade Staked SOL  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Decentraland

Decentraland  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Pendle

Pendle  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Zcash

Zcash  Eigenlayer

Eigenlayer  Mog Coin

Mog Coin  Jito

Jito  Chiliz

Chiliz  Akash Network

Akash Network  ai16z

ai16z  Conflux

Conflux  Wormhole

Wormhole  Popcat

Popcat  Mina Protocol

Mina Protocol  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Jupiter Staked SOL

Jupiter Staked SOL  USDD

USDD  Compound

Compound  Ronin

Ronin  SuperVerse

SuperVerse  SPX6900

SPX6900  PancakeSwap

PancakeSwap  Synthetix Network

Synthetix Network  eCash

eCash  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Chia

Chia  dYdX

dYdX  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Amp

Amp  Peanut the Squirrel

Peanut the Squirrel  Axelar

Axelar  ZKsync

ZKsync  Notcoin

Notcoin  Ether.fi Staked BTC

Ether.fi Staked BTC  CHEX Token

CHEX Token  LayerZero

LayerZero  Tether Gold

Tether Gold  Baby Doge Coin

Baby Doge Coin  Mantle Restaked ETH

Mantle Restaked ETH  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Vana

Vana  Turbo

Turbo  Usual

Usual  Oasis

Oasis  Blur

Blur  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Safe

Safe  1inch

1inch  Super OETH

Super OETH  Echelon Prime

Echelon Prime  Trust Wallet

Trust Wallet  Goatseus Maximus

Goatseus Maximus  Creditcoin

Creditcoin  Beldex

Beldex  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  sUSDS

sUSDS  PayPal USD

PayPal USD  Livepeer

Livepeer  APENFT

APENFT  PAX Gold

PAX Gold  Gigachad

Gigachad  pumpBTC

pumpBTC  Kusama

Kusama  Arkham

Arkham  Nervos Network

Nervos Network  DeXe

DeXe  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)