Data highlights Bitcoin’s potential path to $40K amid global economic turbulence

Bitcoin (BTC) has been trading within a narrow 4.5% range over the past two weeks, indicating a level of consolidation around the $34,700 mark.

Despite the stagnant prices, the 24.2% gains since Oct. 7 instill confidence, driven by the impending effects of the 2024 halving and the potential approval of a Bitcoin spot exchange-traded fund (ETF) in the United States.

Investors worry about the bearish global economic outlook

Bears expect further macroeconomic data supporting a global economic contraction as the U.S. Federal Reserve holds their interest rate above 5.25% in order to curb inflation. For instance, on Nov. 6, China exports shrank 6.4% from a year earlier in October. Furthermore, Germany reported October industrial production down 1.4% versus prior month on Nov. 7.

The weaker global economic activity has led to WTI oil prices dipping below $78 for the first time since late July, despite the potential for supply cuts from major oil producers. Remarks by U.S. Federal Reserve Bank of Minneapolis President Neel Kashkari on Nov. 6 has set a bearish tone, prompting a ‘flight-to-quality’ response.

Kashkari stated:

“ We haven’t completely solved the inflation problem. We still have more work ahead of us to get it done.»

Investors have sought refuge in U.S. Treasuries, resulting in the 10-year note yield dropping to 4.55%, its lowest level in six weeks. Curiously, the S&P 500 stock market index has reached 4,383 points, its highest level in nearly seven weeks, defying expectations during a global economic slowdown.

This phenomenon can be attributed to the fact that the firms within the S&P 500 collectively hold $2.6 trillion in cash and equivalents, offering some protection as interest rates remain high. Despite increasing exposure to major tech companies, the stock market provides both scarcity and dividend yield, aligning with investor preferences during times of uncertainty.

Meanwhile, Bitcoin’s futures open interest has reached its highest level since April 2022, standing at $16.3 billion. This milestone gains even more significance as the Chicago Mercantile Exchange (CME) solidifies its position as the second-largest market for BTC derivatives.

Healthy demand for Bitcoin options and futures

Recent use of Bitcoin futures and options have made media headlines. The demand for leverage is likely fueled by what investors believe are the two most bullish catalyst for 2024: the potential for a spot BTC ETF and the Bitcoin halving.

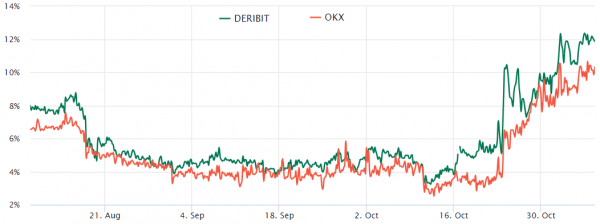

One way to gauge market health is by examining the Bitcoin futures premium, which measures the difference between two-month futures contracts and the current spot price. In a robust market, the annualized premium, also known as the basis rate, should typically fall within the 5% to 10% range.

Bitcoin 2-month futures annualized premium (basis). Source: Laevitas.ch

Notice how this indicator has reached its highest level in over a year, at 11%. This indicates a strong demand for Bitcoin futures primarily driven by leveraged long positions. If the opposite were true, with investors heavily betting on Bitcoin’s price decline, the premium would have remained at 5% or lower.

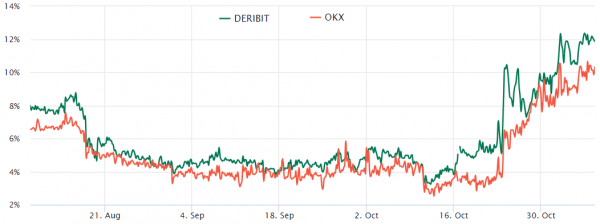

Another piece of evidence can be derived from the Bitcoin options markets, comparing the demand between call (buy) and put (sell) options. While this analysis doesn’t encompass more intricate strategies, it offers a broad context for understanding investor sentiment.

Deribit BTC options put-to-call 24h volume ratio. Source: Laevitas.ch

Over the past week, this indicator has averaged 0.60, reflecting a 40% bias favoring call (buy) options. Interestingly, Bitcoin options open interest has seen a 51% increase over the past 30 days, reaching $15.6 billion, and this growth has also been driven by bullish instruments, as indicated by the put-to-call volume data.

As Bitcoin’s price reaches its highest level in 18 months, some degree of skepticism and hedging might be expected. However, the current conditions in the derivatives market reveal healthy growth with no signs of excessive optimism, aligning with the bullish outlook targeting $40,000 and higher prices by year-end.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Stellar

Stellar  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Render

Render  MANTRA

MANTRA  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Ethena

Ethena  Dai

Dai  Arbitrum

Arbitrum  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  dogwifhat

dogwifhat  The Graph

The Graph  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sei

Sei  Worldcoin

Worldcoin  Pudgy Penguins

Pudgy Penguins  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Gate

Gate  GALA

GALA  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  Tokenize Xchange

Tokenize Xchange  Beam

Beam  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  The Sandbox

The Sandbox  Pyth Network

Pyth Network  Usual USD

Usual USD  Tezos

Tezos  NEXO

NEXO  Kaia

Kaia  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  KuCoin

KuCoin  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Jupiter

Jupiter  Aerodrome Finance

Aerodrome Finance  Flow

Flow  Starknet

Starknet  Arweave

Arweave  IOTA

IOTA  Bitcoin SV

Bitcoin SV  dYdX

dYdX  AIOZ Network

AIOZ Network  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Core

Core  Marinade Staked SOL

Marinade Staked SOL  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Decentraland

Decentraland  ether.fi Staked ETH

ether.fi Staked ETH  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  ApeCoin

ApeCoin  Pendle

Pendle  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Fartcoin

Fartcoin  Zcash

Zcash  Mog Coin

Mog Coin  Eigenlayer

Eigenlayer  Jito

Jito  Chiliz

Chiliz  Akash Network

Akash Network  Conflux

Conflux  Wormhole

Wormhole  Popcat

Popcat  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Mina Protocol

Mina Protocol  Jupiter Staked SOL

Jupiter Staked SOL  Compound

Compound  USDD

USDD  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  SPX6900

SPX6900  Synthetix Network

Synthetix Network  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  eCash

eCash  Chia

Chia  dYdX

dYdX  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Amp

Amp  Gnosis

Gnosis  ZKsync

ZKsync  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Peanut the Squirrel

Peanut the Squirrel  Notcoin

Notcoin  Axelar

Axelar  Ether.fi Staked BTC

Ether.fi Staked BTC  CHEX Token

CHEX Token  LayerZero

LayerZero  Tether Gold

Tether Gold  Baby Doge Coin

Baby Doge Coin  Mantle Restaked ETH

Mantle Restaked ETH  Reserve Rights

Reserve Rights  Terra Luna Classic

Terra Luna Classic  Vana

Vana  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Grass

Grass  Turbo

Turbo  Oasis

Oasis  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Usual

Usual  Blur

Blur  Super OETH

Super OETH  Safe

Safe  1inch

1inch  Trust Wallet

Trust Wallet  Echelon Prime

Echelon Prime  Creditcoin

Creditcoin  Goatseus Maximus

Goatseus Maximus  Beldex

Beldex  Livepeer

Livepeer  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  sUSDS

sUSDS  PayPal USD

PayPal USD  Gigachad

Gigachad  PAX Gold

PAX Gold  APENFT

APENFT  Kusama

Kusama  Arkham

Arkham  Nervos Network

Nervos Network  pumpBTC

pumpBTC  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)