Biden’s Blunder Ignites Trading Frenzy on Polymarket

This week in prediction markets:

Will he stay or will he go?

Short term stability for BTC prices, but a dip below $50K is in the cards before a rally to over $75K

«Stranded» astronauts unlikely to depart International Space Station via Boeing ship in late July

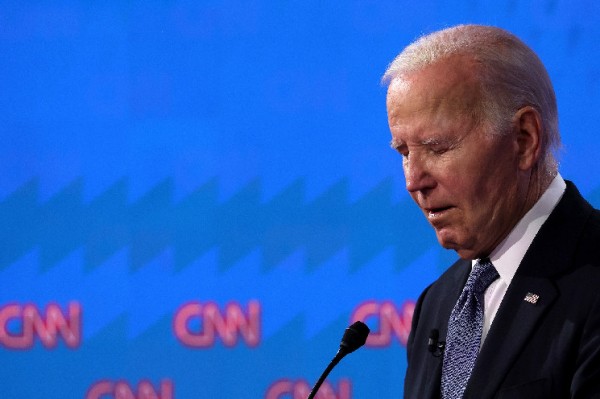

U.S. President Joe Biden’s performance at last week’s presidential debate was an unmitigated disaster.

The New York Times’ editorial board, usually a source of stalwart support for a Democratic White House, is calling on him to step down. A CBS/YouGov poll says that 72% of voters believe that Biden does not have the cognitive health to serve as President.

This was a betting bonanza for users of Polymarket, the crypto-based prediction market platform.

Biden’s odds of becoming President dropped from 33.5% pre-debate to 18% as of Monday morning U.S. time, with Trump solidifying his lead at 63%.

Another contract, this one about the possibility of Biden dropping out of the race entirely, also rocketed off in trading volume post-debate, with «yes» shares hitting 44 cents in the hours after, up from 19 cents prior.

Each share pays out $1 (in the USDC stablecoin) if the prediction comes true and zero if not, so the 44 cent price indicated a 44% probability Biden would bow out.

A story from NBC that Biden was to spend the weekend with his family at the Mount David Presidential retreat to discuss the future of his campaign pushed the odds up to 50%.

Those odds leveled out to just over 40% as of Monday morning U.S. time as over the weekend the White House pushed back on reports, saying the trip was pre-planned.

For his part, President Biden is adamant that he will remain in the race.

“I understand the concern after the debate. I get it,” NPR quoted the President as saying to a room full of donors. “I didn’t have a great night. But I’m going to be fighting harder and going to need you with me to get it done.”

The contract has attracted serious political bettors, with the largest holders on both sides of the digital aisle largely betting on politics-themed markets.

«Therealbatman,» the largest No holder, holds $2.9 million in different political contracts, consistently betting that Biden and Trump will win their respective nominations, that Biden will win the popular vote, and that Trump won’t win the U.S. Presidential Election.

The only exception to Therealbatman’s largely political portfolio involves a $50,000 bet that the Eigen token, the native token for the Eigenlayer protocol, won’t be transferable before former Binance CEO Changpeng «CZ» Zhao, gets out of prison.

On the other side of the aisle, the largest holder of the «yes» side of the Biden drop-out contract, an anonymous user only known by his or her Ethereum wallet address, holds a $184,000 position on Biden’s fate, as well as a $6,200 stake that Michelle Obama will with the Democratic nomination.

This user also has a $9,700 bet that longshot independent candidate Robert F. Kennedy Jr. will win the presidential election, which is currently trading at 2 cents.

Bitcoin price predictions

Traders on prediction markets have mixed opinions on where the price of bitcoin is going.

In the short term: stability.

A Polymarket contract gives bitcoin a 78% chance of being above $61,000 by July 5.

For reference, CoinDesk Indices data had bitcoin trading above $63,300 for most of the Monday business day in Asia, a marked recovery from its tests below $60,000 as last week began.

CoinDesk Indices’ Bitcoin Trend Indicator notes that the world’s largest digital asset is in a period of «significant downtrend.»

Here’s where things start to get complicated. The markets «tea leaves» that bettors are trying to read put us in for a correction before a rally that might test BTC’s all-time high.

First, one contract on the U.S.-regulated Kalshi platform projects a 65% chance of bitcoin dipping below $50,000 by the end of 2024 and a 22% chance of it reaching below $40,000. At the same time, another contract projects a 70% chance of BTC hitting $75,000 or above by the end of the year.

Unlike Polymarket, which does business almost everywhere except the U.S., Kalshi is U.S.-only, and its bets are settled in dollars.

There are a couple of indicators that the market expects bitcoin’s price to be challenged by continued dollar strength. This will certainly subside once the Federal Reserve begins to cut rates, which bettors are almost certain will happen by the last quarter.

Stranded in space

Boeing has had a tough time on Earth and its troubles seem to have extended past the confines of the planet.

The troubled aerospace giant’s first space capsule is stuck at the International Space Station (ISS) after helium leaks and thruster issues have kept it docked without a definite return date. Starliner’s trip was supposed to conclude on June 13.

Bettors think that the astronauts will be on the ISS for some time longer, with a Polymarket contract giving only an 11% chance of the astronauts departing on the Starliner by July 21.

The market’s fine print says that the astronauts must depart on Boeing’s Starliner. A rescue vessel from SpaceX or Russia won’t count. Nor does it specify that the astronauts would have to safely return to Earth.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Gate

Gate  Quant

Quant  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  Pyth Network

Pyth Network  KuCoin

KuCoin  NEXO

NEXO  Tezos

Tezos  Kaia

Kaia  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Arweave

Arweave  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Decentraland

Decentraland  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Pendle

Pendle  Zcash

Zcash  ApeCoin

ApeCoin  Fartcoin

Fartcoin  ether.fi Staked ETH

ether.fi Staked ETH  Jito

Jito  Eigenlayer

Eigenlayer  Mog Coin

Mog Coin  Chiliz

Chiliz  Akash Network

Akash Network  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  Popcat

Popcat  SPX6900

SPX6900  Mina Protocol

Mina Protocol  Jupiter Staked SOL

Jupiter Staked SOL  Compound

Compound  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  SuperVerse

SuperVerse  PancakeSwap

PancakeSwap  Ronin

Ronin  eCash

eCash  Synthetix Network

Synthetix Network  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  Amp

Amp  Axelar

Axelar  dYdX

dYdX  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  Terra Luna Classic

Terra Luna Classic  CHEX Token

CHEX Token  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Turbo

Turbo  Vana

Vana  Safe

Safe  Super OETH

Super OETH  cat in a dogs world

cat in a dogs world  Oasis

Oasis  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  Usual

Usual  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD