Can XRP Hit a New Yearly High Following SEC Case Dismissal?

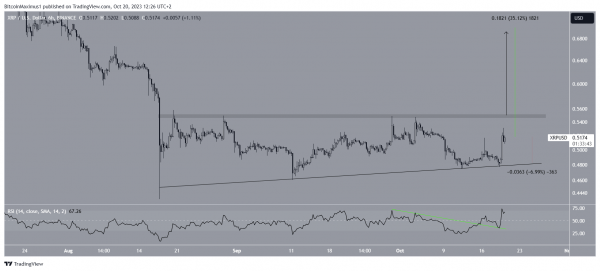

The Ripple XRP price has decreased since July. It broke down from the $0.53 area in August.

Despite this breakdown, the price has regained its footing and is attempting to reclaim the $0.53 area. Will it be successful?

Ripple Breaks Out From Resistance Trendline

The daily timeframe technical analysis shows that the XRP price has fallen under a descending resistance trendline since its yearly high of $0.94 in July.

The decrease led to a low of $0.42 in August, causing a breakdown from the $0.53 horizontal support area, which now turned to resistance.

After several unsuccessful attempts (red icons) at breaking out from the trendline, XRP finally created a large bullish candlestick and broke out on October 19.

The XRP price still trades below the $0.53 horizontal resistance area despite the breakout.

XRP/USDT Daily Chart. Source: TradingView

Recent Ripple Developments Signal Bullish Momentum

Some positive Ripple vs Securities and Exchange Commission (SEC) news hit today’s market. The SEC has dropped its lawsuit against Ripple CEO Brad Garlinghouse and co-founder Chris Lawson.

This comes after a judge denied the SEC’s appeal from a ruling that favored Ripple Labs earlier this year.

This timing is interesting since it follows a recent job opening for the “Shareholders Communication Senior Manager” position, which fueled speculation that Ripple is planning an IPO in the future.

Finally, the Ripple Swell conference is just around the corner, with its main event scheduled for November 8-9. This prominent gathering will feature diverse speakers, including Brad Garlinghouse.

Click here for Ripple-XRP price predictions.

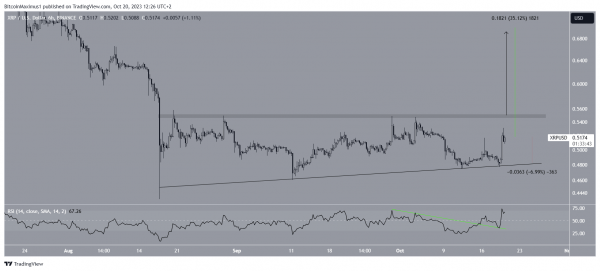

XRP Price Prediction: Will it Reclaim the $0.53 Area?

The shorter-term six-hour timeframe price action and Relative Strength Index (RSI) both support the possibility of an ongoing increase.

The price action shows that XRP has traded inside an ascending triangle since August. The ascending triangle is considered a bullish pattern, leading to breakouts most of the time.

By using the RSI as a momentum indicator, Traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward. But the opposite is true if the reading is below 50.

The RSI is above 50 and increasing, both signs of a bullish trend. Also, it has broken out from its descending resistance trendline (green).

An upward movement that travels the entire pattern’s height will take XRP to $0.70, a 35% increase from the current price.

On-chain data also supports this sentiment. Wallets with 10,000 – 10,000,000 XRP currently hold the highest amount since July 27, while XRP social dominance reached its second highest day in more than a month.

XRP/USDT Daily Chart. Source: TradingView

Despite this bullish XRP price prediction, a rejection from the $0.55 area can cause a 7% drop to the long-term ascending support line at $0.49.

For BeInCrypto’s latest crypto market analysis, click here.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Quant

Quant  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  KuCoin

KuCoin  Pyth Network

Pyth Network  NEXO

NEXO  Kaia

Kaia  Tezos

Tezos  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Zcash

Zcash  Eigenlayer

Eigenlayer  Jito

Jito  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  SPX6900

SPX6900  Popcat

Popcat  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  Synthetix Network

Synthetix Network  eCash

eCash  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  dYdX

dYdX  Amp

Amp  Axelar

Axelar  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Turbo

Turbo  Safe

Safe  Super OETH

Super OETH  Usual

Usual  Oasis

Oasis  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD