FOMC Preview: Bitcoin and Crypto’s Fate Tied To Fed Rate Move

In the lead-up to the Federal Open Market Committee (FOMC) meeting scheduled for Wednesday, March 20, the Bitcoin and crypto market is experiencing a severe downtrend. BTC price has plunged roughly -10% in the past two days, and Ethereum (ETH) is down -12% in the same period.

The anticipation surrounding the Fed’s stance on interest rates has heightened in the wake of recent economic indicators, including unexpected spikes in the US Consumer Price Index (CPI) and Producer Price Index (PPI), stirring volatility across markets, including digital assets.

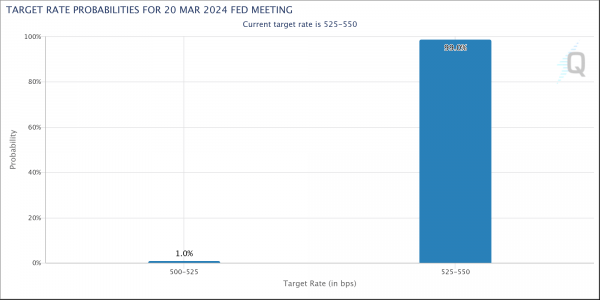

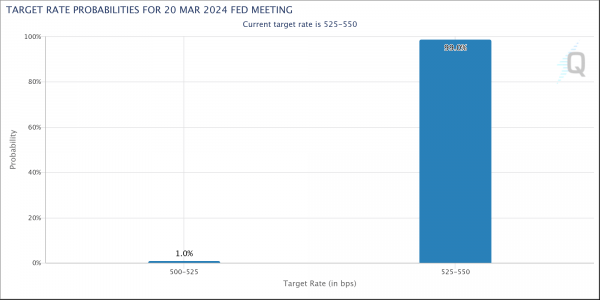

The consensus, with a 99% probability according to the CME FedWatch tool, suggests interest rates will hold steady. Nonetheless, the spotlight turns to the Fed’s dot plot, a graphical representation of the individual members’ expectations for future interest rates, which could provide crucial insights into the monetary policy outlook for the coming months and years.

Anna Wong, Chief US Economist for Bloomberg, remarked via X (formerly Twitter), “Another reason why FOMC [is] not ready to cut: members not yet of broad agreement of that need. Here’s visualizing the dispersion of FOMC views with the help of our new weekly NLP Fed spectrometer. “

Another reason why FOMC not ready to cut: members not yet of broad agreement of that need. Here’s visualizing the dispersion of FOMC views with the help of our new weekly NLP Fed spectrometer. (Interactive version at @TheTerminal BECO models —> Fedspeak —> spectrometer) pic.twitter.com/Kney89BERM

— Anna Wong (@AnnaEconomist) March 19, 2024

How Will Bitcoin And Crypto React?

Macro analyst Ted, expressing his perspective on X, underscores the nuanced relationship between macroeconomic trends and the crypto market at the moment. Ted elucidated that spot Bitcoin ETF flows have taken the backseat while macro factors came to the foreground.

He stated via X, “If BTC is to be considered digital gold, it’s expected to mirror gold’s market movements, albeit with a higher degree of volatility. In the current climate, with the market bracing for the Fed’s upcoming meeting, macroeconomic factors momentarily take precedence, driven by recent developments in PPI and CPI figures.”

He further speculates that “Despite the eventual remarks from [Fed Chair] Powell, the market has already adopted a hawkish stance in anticipation of a ‘higher for longer’ interest rate scenario.”

Related Reading: Japan’s $1.5 Trillion Pension Fund To Assess Bitcoin For Diversification

Michaël van de Poppe, a noted figure in the crypto analysis domain, provided his insights on the recent downward price movement of Bitcoin via X, citing a mix of factors including the anticipation of the FOMC meeting and significant capital outflows from Grayscale‘s Bitcoin Trust. Van de Poppe advises, “It’s typically in these pre-FOMC periods, perceived as risk-off intervals, that the savvy investor finds opportunities to ‘buy the dip’.”

In a reflection of market sentiment adjustments, analyst @10delta on X pointed out the strategic positioning of investors in anticipation of the Fed’s rate decisions. “The market is currently pricing in a reversal to the November ’23 interest rate levels, a clear indication that investors are adjusting their expectations based on the Fed’s potential pivot signaled in the previous dot plot,” he noted.

Accordingly, he argues that the FOMC & dot plot will be a “buy the news” event as the market expectations are being properly adjusted. “The macro worries […] should dissipate & crypto idiosyncratic bullish factors, such as the ETF inflows […] as well as the BTC halving take hold. All considered I think there’s a good R/R for ‘buying the dip’ heading into the March 20 event,” the analyst added.

Goldman Sachs Predicts (Only) 3 Rate Cuts This Year

Goldman Sachs Research recently provided a detailed analysis in their March FOMC Preview. The report highlights the nuanced balance the Fed seeks to achieve between controlling inflation and supporting economic growth.

Related Reading: Profit-Taking Panic, Short-Term Bitcoin Holders Sell Off – What’s Next For BTC?

“Our revised forecast now anticipates three rate cuts in 2024, a slight adjustment from our previous prediction, primarily due to a modest uptick in the inflation trajectory,” Goldman Sachs analysts elucidated. They further speculate, “While the immediate focus is on maintaining current rate levels, the trajectory for rate cuts will hinge on inflation dynamics and economic performance indicators.”

Goldman Sachs further predicts that the Fed will still target a first cut in June. “This combined with a default pace of one cut per quarter implies that the most natural outcome for the median dot is to remain unchanged at 3 cuts or 4.625% for 2024,” the banking giant remarked.

Goldman: Inflation has been firmer in recent months, but we think it is still on track to fall enough by the June FOMC meeting for a first cut. pic.twitter.com/0I1BPYiU8W

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 17, 2024

As the crypto market and broader financial ecosystems await the outcomes of the FOMC meeting, the prevailing sentiment is one of cautious anticipation. Market participants are closely monitoring the Fed’s commentary for indications of future monetary policy directions via the dot plot.

The question for the Bitcoin and crypto market is whether there will be an unpleasant surprise or whether market participants were right with their “higher for longer” policy assumption.

At press time, BTC found support at the $62,400 price level, trading at $63,118.

Featured image from Shutterstock, chart from TradingView.com Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Sui

Sui  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  Virtuals Protocol

Virtuals Protocol  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Binance-Peg WETH

Binance-Peg WETH  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Gate

Gate  Quant

Quant  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  Pyth Network

Pyth Network  KuCoin

KuCoin  NEXO

NEXO  Tezos

Tezos  Kaia

Kaia  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Raydium

Raydium  Brett

Brett  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Arweave

Arweave  Core

Core  AIOZ Network

AIOZ Network  IOTA

IOTA  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Fartcoin

Fartcoin  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Pendle

Pendle  Zcash

Zcash  ApeCoin

ApeCoin  Jito

Jito  ether.fi Staked ETH

ether.fi Staked ETH  Mog Coin

Mog Coin  Akash Network

Akash Network  Eigenlayer

Eigenlayer  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Wormhole

Wormhole  Conflux

Conflux  USDD

USDD  Popcat

Popcat  Jupiter Staked SOL

Jupiter Staked SOL  Mina Protocol

Mina Protocol  Compound

Compound  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  SPX6900

SPX6900  Ronin

Ronin  SuperVerse

SuperVerse  PancakeSwap

PancakeSwap  eCash

eCash  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Synthetix Network

Synthetix Network  Gnosis

Gnosis  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  Chia

Chia  Axelar

Axelar  dYdX

dYdX  Amp

Amp  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Grass

Grass  Turbo

Turbo  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Super OETH

Super OETH  Safe

Safe  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Oasis

Oasis  Echelon Prime

Echelon Prime  Blur

Blur  Beldex

Beldex  1inch

1inch  Usual

Usual  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  DeXe

DeXe  Livepeer

Livepeer  pumpBTC

pumpBTC  Creditcoin

Creditcoin  APENFT

APENFT  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  TrueUSD

TrueUSD  Arkham

Arkham