XRP Drops: Why Is It Bullish? Dogecoin (DOGE) Delivers Crucial Signal, Shiba Inu (SHIB) Boom Turns to Bust

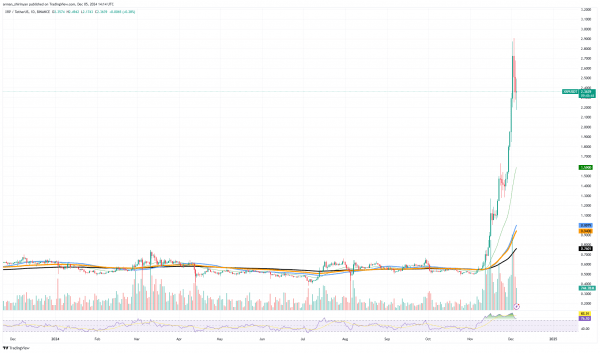

Concern among investors has been raised by XRP’s notable 25% decline in value. This correction may not be as concerning as it first appears, though. The cryptocurrency was in overbought territory after its recent explosive rally, and this pullback might just be a healthy retracement that paves the way for further growth.

XRP’s explosive surge to above $3 was driven by robust momentum and rekindled market interest. But like any rally, there would inevitably be a retracement. With this decline, XRP is now nearer more reliable support levels like $2.30 and $1.95, which may serve as the basis for a subsequent move. XRP has shown resilience by staying well above its prior long-term resistance levels in spite of a steep drop.

The asset is still above its major moving averages such as the 50-day EMA, which has a track record of serving as a dependable support area during declines. This correction may be a much-needed reprieve that will help XRP gain momentum. A fresh round of buying could drive the asset back toward $3 and possibly higher if it can hold steady around the $2.30 level and sustain trading volume.

However, significant bullish momentum and wider market support are needed to break above $3 once more. The next crucial zone on the downside is located at $1.95 if XRP is unable to maintain its support levels. If it falls below this, it might be an indication of a more significant correction, which could temporarily erode investor confidence.

It is crucial to consider the recent performance of XRP when evaluating the 25% decline, even though it may seem concerning. Investors may use the pullback as a chance to review their holdings and wait for the market to level off. The speed at which XRP recovers and its ability to maintain its momentum in the upcoming weeks will determine much of its future. Currently, the drop is more of a reset than a crisis.

Dogecoin retraces

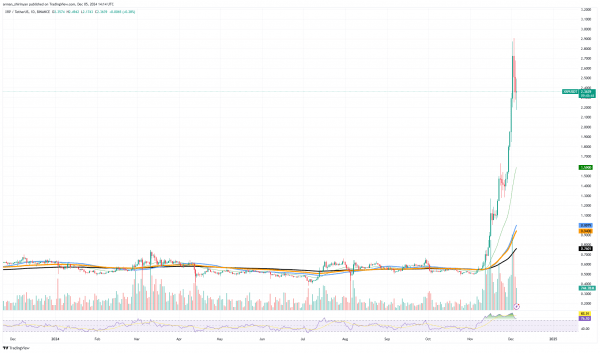

Following its spectacular recent rally, Dogecoin has been on a steady upward trajectory, holding its position close to $0.044. Nevertheless, a crucial indicator that coincides with the surge is a decline in trading volume. The current uptrend’s sustainability is called into question by this discrepancy between volume and price action. Instead of the earlier explosive spikes, DOGE’s price movement has been marked by consistent gains.

The absence of supporting volume raises the possibility that buyers are not as convinced, even though this controlled ascent usually denotes healthy growth. Strong upward trends are frequently supported by higher trading activity, which strengthens support and lessens the chance of a precipitous decline.

The decreasing volume could indicate that DOGE is losing traction and could be subject to a correction. The asset runs the danger of retracing to its prior support levels, especially those around $0.37 and $0.28 in the absence of fresh buying interest. Targeting the $0.50 level as the next psychological resistance, DOGE may continue to rise if it can draw in more buyers and volume increases.

But if there is not any notable volume growth, selling pressure will probably increase, which could cause the price to decline toward the crucial support zone at $0.37. There are risks and opportunities associated with Dogecoin’s current position. The volume will probably determine the asset’s short-term course, so traders and investors should keep a careful eye on it in the days ahead.

Shiba Inu’s quick ascent

The price of Shiba Inu recently reached remarkable highs above $0.000033 due to a notable spike in volatility. But the rally soon lost steam, and it abruptly turned around. This pattern of explosive growth followed by swift corrections has become a recurring theme for SHIB, underscoring the challenges it faces in maintaining upward momentum. Increased speculation and rekindled interest in meme coins propelled by general market optimism are responsible for the initial spike.

The strong trading volume that accompanied Shiba Inu’s breakout from its consolidation phase was crucial in drawing in traders seeking rapid profits. Additionally, on-chain information indicated an increase in active addresses and transaction volumes, which momentarily reinforced SHIB’s upward trend. Although the rally was spectacular, SHIB was unable to maintain its gains.

Buyers’ failure to follow through and a decline in trading volume caused a swift reversal. After failing to overcome the resistance at $0.000033, the price has since retraced to the $0.000031 level, where it is currently trading close to its most recent support. The fact that momentum has slowed emphasizes how speculative SHIB’s market activity is.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena  Filecoin

Filecoin  Fantom

Fantom  Algorand

Algorand  OKB

OKB  Virtuals Protocol

Virtuals Protocol  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Ondo

Ondo  Optimism

Optimism  Bonk

Bonk  Immutable

Immutable  Celestia

Celestia  Movement

Movement  Theta Network

Theta Network  Injective

Injective  Binance-Peg WETH

Binance-Peg WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  The Graph

The Graph  dogwifhat

dogwifhat  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Quant

Quant  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  GALA

GALA  Lombard Staked BTC

Lombard Staked BTC  Maker

Maker  Beam

Beam  Usual USD

Usual USD  The Sandbox

The Sandbox  KuCoin

KuCoin  Pyth Network

Pyth Network  NEXO

NEXO  Kaia

Kaia  Tezos

Tezos  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Brett

Brett  Raydium

Raydium  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  Starknet

Starknet  Arweave

Arweave  Bitcoin SV

Bitcoin SV  IOTA

IOTA  AIOZ Network

AIOZ Network  dYdX

dYdX  BitTorrent

BitTorrent  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  Core

Core  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  ApeCoin

ApeCoin  Fartcoin

Fartcoin  Zcash

Zcash  Eigenlayer

Eigenlayer  Jito

Jito  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  ai16z

ai16z  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Conflux

Conflux  Wormhole

Wormhole  USDD

USDD  SPX6900

SPX6900  Popcat

Popcat  Mina Protocol

Mina Protocol  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ronin

Ronin  PancakeSwap

PancakeSwap  SuperVerse

SuperVerse  Synthetix Network

Synthetix Network  eCash

eCash  Gnosis

Gnosis  DOG•GO•TO•THE•MOON (Runes)

DOG•GO•TO•THE•MOON (Runes)  Chia

Chia  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Ether.fi Staked BTC

Ether.fi Staked BTC  dYdX

dYdX  Amp

Amp  Axelar

Axelar  Notcoin

Notcoin  ZKsync

ZKsync  Tether Gold

Tether Gold  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Mantle Restaked ETH

Mantle Restaked ETH  CHEX Token

CHEX Token  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  Grass

Grass  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Baby Doge Coin

Baby Doge Coin  Vana

Vana  Turbo

Turbo  Safe

Safe  Super OETH

Super OETH  Usual

Usual  Oasis

Oasis  cat in a dogs world

cat in a dogs world  ORDI

ORDI  Echelon Prime

Echelon Prime  Blur

Blur  1inch

1inch  Beldex

Beldex  Trust Wallet

Trust Wallet  sUSDS

sUSDS  PayPal USD

PayPal USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  PAX Gold

PAX Gold  Creditcoin

Creditcoin  pumpBTC

pumpBTC  APENFT

APENFT  Livepeer

Livepeer  Goatseus Maximus

Goatseus Maximus  Gigachad

Gigachad  DeXe

DeXe  Arkham

Arkham  TrueUSD

TrueUSD